After a 6-month advance, it looks like the stock market may be rolling over into an intermediate decline. Downside follow-through next week will confirm.

Algo-trading makes up approximately 90% of daily trading activity. Occasionally, when all the stars align, these systems flood the market with sell orders and trigger a 1-3 day flash crash. I don’t know if that will happen this time, but I have a position in TVIX in case it does.

Oil blasted by the $74.08 target and beyond my 29-31 day cycle series. Prices may have topped on day 33, but it’s too soon to tell. Closing below the 10-day EMA would support a top.

I’ve been under the impression that oil and stocks would decline together in October. The setup is there – let’s see what happens next.

Metals and Miners are consolidating after reaching their August/September lows. Overall, I think they could reach better lows by year-end, but I can’t rule out an extended rebound into mid-late October. I highlight key levels to monitor in each.

-US DOLLAR- The dollar stopped at the B-wave high. If prices pullback here, they need to hold at the support box. A sustained move below the support box would prescribe a failed cycle and lower prices.

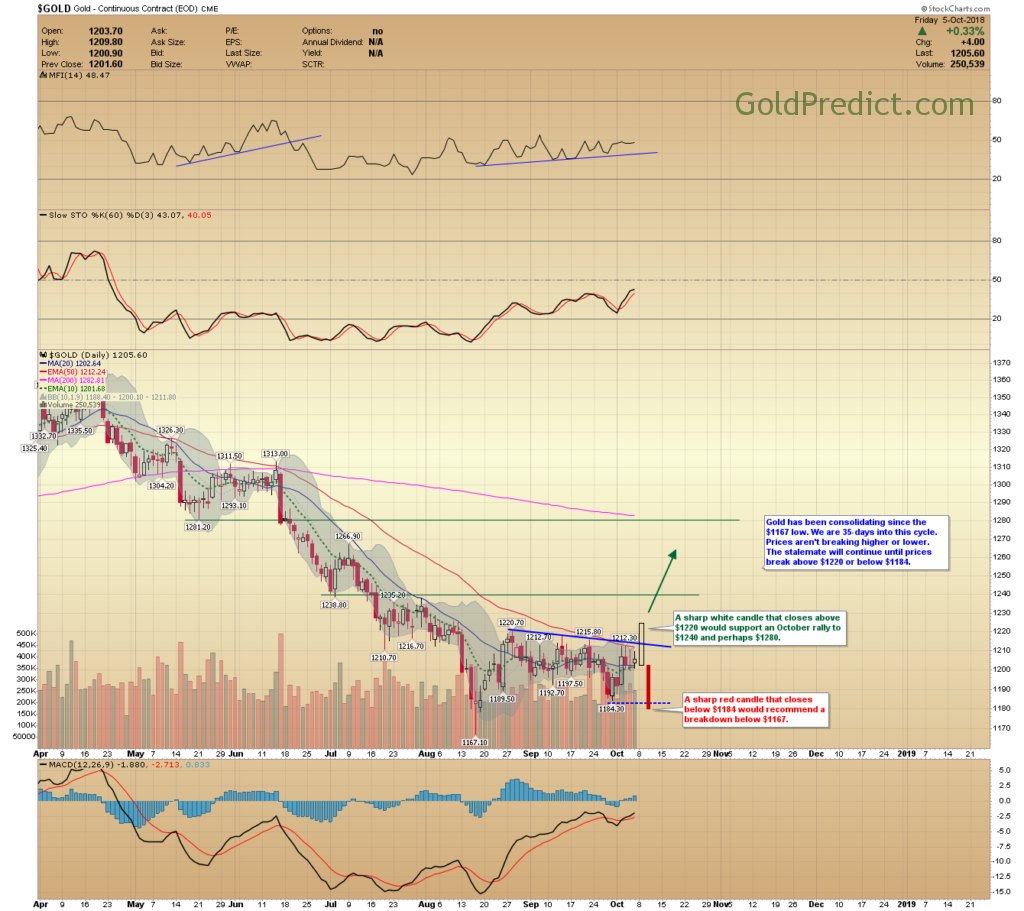

-GOLD- Gold has been consolidating since the $1167 low. We are 35-days into this cycle. Prices aren’t breaking higher or lower. The stalemate will continue until prices break above $1220 or below $1184. A sharp white candle that closes above $1220 would support an October rally to $1240 and perhaps $1280. A cutting red candle decline that closes below $1184 would recommend a breakdown below $1167.

-SILVER- Silver needs to close decisively above $15.00 or below the short-term trendline for its next range.

-GDX- There is stiff resistance around the $19.75 level. Prices would have to close above the potential reversal box to support a rally to $20.50 – $21.00. Whereas, closing below $18.14 would presumably trigger another sharp decline.

Leave A Comment