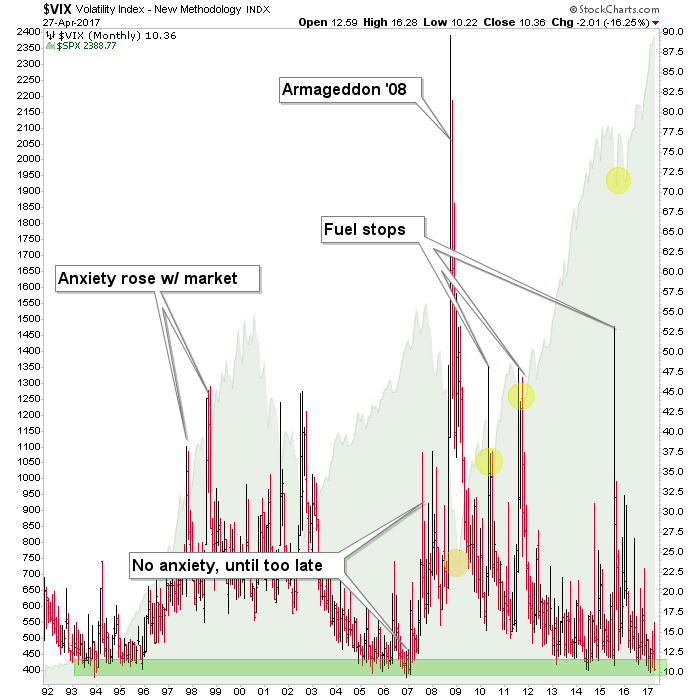

It’s a big picture view with a story to tell. People are micro-managing the VIX, talking about how it either doesn’t work anymore, if it ever did, or is forecasting extreme doom imminently (through investor complacency). But what is “imminently”? Is it next month or is it the 2-3 years that this indicator often wallows along the bottom of its support zone before overseeing a coming Armageddon? Sure, it started wallowing in the zone back in 2013, but then the ‘fuel stops’ that were ultimately bullish (the 2010, 2011 and 2015 corrections) cleared the overhead inventory of investors out of the markets.

Sometimes you’ve got to let a picture marinate and tell its story, not impose your (relatively) hypersensitive brainwaves on it. The story this thing is telling is that Armageddon ’08 surely was a massive sentiment reset (of much greater power and significance than I originally thought it would be, when I got bullish in early 2009). On top of that big sentiment event that cleaned the markets out to a fully sanitized state, there were 3 subsequent eruptions of bearishness that may have reinforced the message of the 2008 disaster, sternly reminding casino patrons that this thing is not safe.

And yet up go the prices of stocks, and down goes the VIX. The problem for bears who would like to sharpen their claws for a ‘fish in a barrel’ opportunity, is that 3rd fuel stop of the current bull market, from 2015. VIX is in the zone, but how many months will it wallow there thanks to the 2015 clean out?

Now let’s look again at the weekly chart of the S&P 500 along with the stubbornly un-bullish AAII (Individual Investors). In NFTRH we have had an open question about whether the AAII will need to finally jerk all-in, similar to 2000, or at least heavily-in, similar to 2010 and 2014 before the bull finally terminates.

Here is another version of the chart, showing the NAAIM (Investment Managers) having sold down during the most recent market consolidation. Now there they go, popping with the market again (‘oh, it’s okay after all’ think the best and brightest managing other peoples’ money… ‘back in the pool!’). These negative sentiment squalls are bullish in a bull market.

Leave A Comment