The next stock valuation is about a stock I recently mentioned in my watch list. It will be about Qualcomm (QCOM) and I just want to give you more details why I am positive about buying some shares in the near future.

Company Overview

Qualcomm Incorporated is a semiconductor company that designs, and manufactures digital wireless telecommunications products and services. The company operates through the following segments: Qualcomm CDMA Technologies, Qualcomm Technology Licensing, Qualcomm Wireless & Internet, and Qualcomm Strategic Initiatives.

Qualcomm was founded in 1985, and is headquartered in San Diego, CA. Qualcomm’s success is tied to its ability to consistently make its semiconductor chips cheaper and faster than its competition. Qualcomm increased its dividends for 14 years and recently announced a dividend increase from 0.53 USD to 0.57 USD per quarter. The next ex-dividend date will be on the 26th of May.

Valuation

Currently QCOM is priced at 52.50 USD per share.

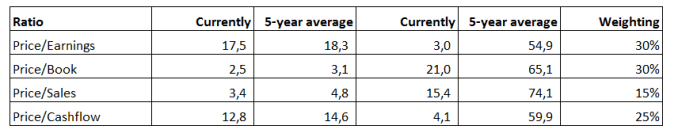

If I take the weighted average of the 4 ratios according to the 5 year average the price would be at 62.09 USD. That means the current price is 15.4% below its 5 year average. The 5 year high was at 81.32 USD which was about 3 years ago, so currently the stock trades 35.3% below its 5-year high.

The fair market value ratio of the semiconductor sector , according to Morningstar is currently at 1.33. If I divide the current price by it I will get a price of 39.47 USD.

Earnings per share growth

In 2011 the EPS were at 2.52 USD and EPS in 2016 were at 3.81 USD. This makes it an average growth per year of 8.65%.This is a quite stable growth but nevertheless I should also mention that in 2013 and 2014 were at higher level than the one of the last year.

Dividend History and Future

QCOM has a good dividend history with increasing the dividend for 14 years in a row. In the last 5 years, the average growth per year is 20.05% based on a dividend of 2.02 USD in 2011 and a current full year one of 2.28 USD. Even though the dividend is already on a very high level the pay out ratio is still on a reasonable level

Leave A Comment