Stocks continued selling today. What was particularly discouraging for the bulls is that there was no afternoon rally. In fact, the selling accelerated in the last hours of trading, and the major indices went out on the lows, and on heavier volume.

One might point to the new tariffs to come on China, and fears of a trade war. Earlier this week one would look to the Fed, and talk about the rising interest rates, probably the most carefully telegraphed monetary decision in history.

Perhaps it was the latest antics of Facebook, in the general growth of the abuse of privacy of the public by government and their corporations. One might also look to the dysfunction in Washington, and the misguided policies that have been crippling the middle and lower classes to the advantage of the one percent.

Let’s skip the usual bullshit exercise of identifying the reasons for this sell off for the moment shall we?

Certain financial assets, like the major stock indices, led narrowly by the FANG tech stocks and the financials, had been lifted to new heights by what certainly looked like the utter mispricing risks.

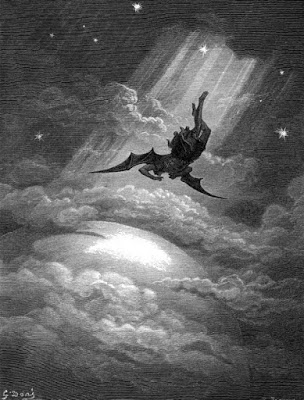

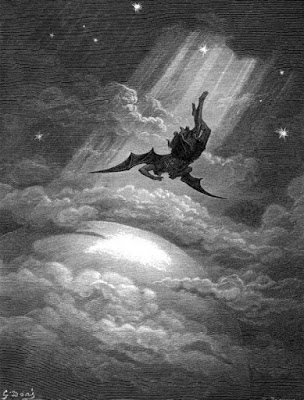

And as we have seen in the last two asset bubbles and subsequent financial crises, prices continued rising to even greater over-valuations.They were lifted on a cloud of misrepresentations andthe purposeful weakening of transparency and regulation, from the purveyors of stocks and their many purveyors of the big lie designed to support the economic status quo.

As I have cautioned,when this mispricing of risk continued to expand,the ‘trigger event’ needed to knock the market off its blocks would decrease in required magnitude, until something incidental, or a cluster of rather minor incidents, would be enough to send prices down, and with a vengeance.

So far this latest market decline is what I would call a ‘market break’ and not a ‘crash.’ As a reminder, there was a disquieting market break in March 1929 that was quickly forgotten, until the market breaks of September, culminating in a bloody October.

Leave A Comment