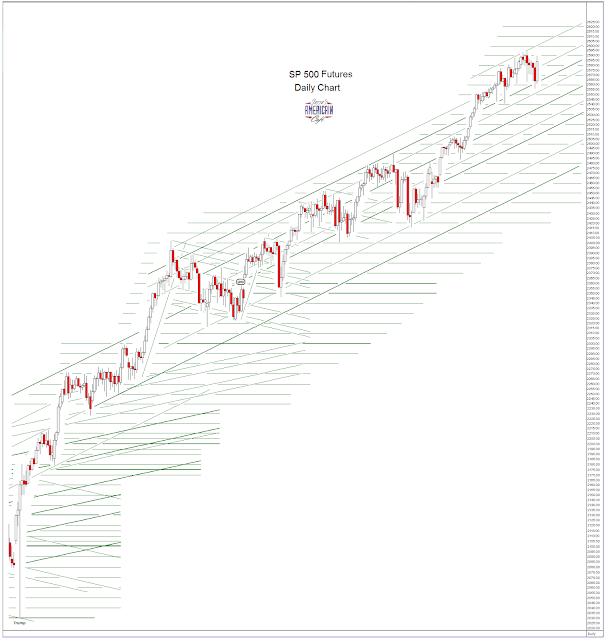

US equities rallied today on the earnings report from WalMart, and an excess of hot money with nowhere productive to go.

Today was characterized as a great time to buy the dip, which occurred earlier this week.

Tomorrow will be a stock options expiration.

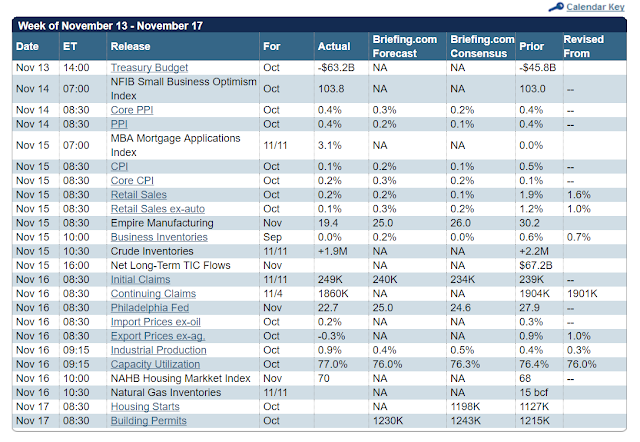

The House passed its version of ‘tax reform’ today. It will have to be reconciled with reform from the Senate.

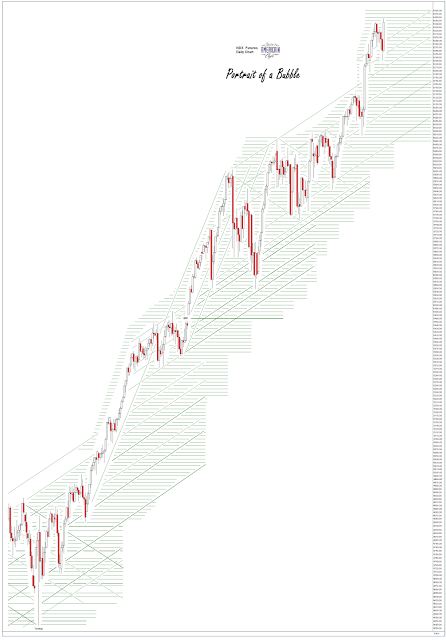

The yield curve differential between the 2y and 10y treasuries continues to flatten, with some suggesting it will go to ‘0’ next year.

This is a signal of an oncoming recession.

The yield shows that the US consumer is ‘tapped out.’

The Fed says that healthcare is contributing to the lack of inflation.

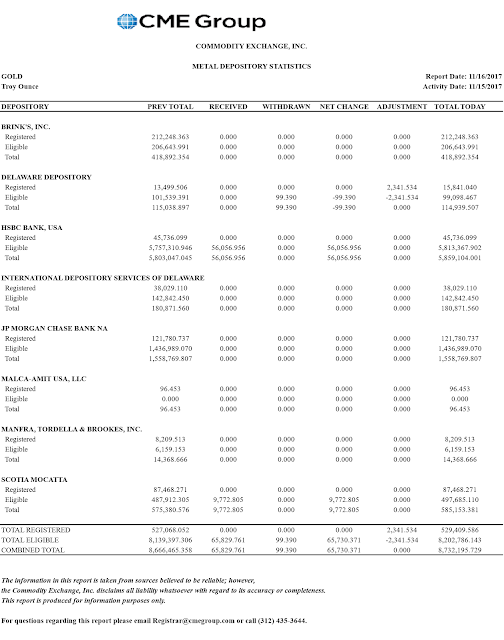

I agree with Jeffrey Gundlach’s

about the carried interest rule in the tax reform legislation, and that the swamp is not being drained, it is getting larger.

Sow it; reap it; eat it.

Leave A Comment