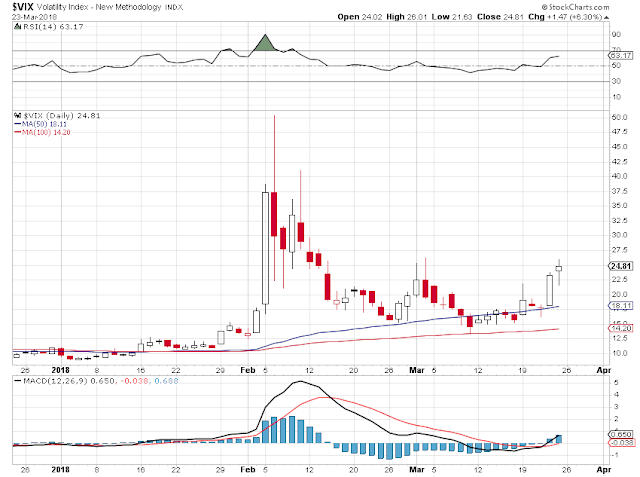

Stocks sold off again today in a big way.

They were able to stabilize the markets this morning, led by buying of the SP 500 futures, long enough to shove the Dropbox IPO out the door, and even gain a bit off the initial pricing.

But alas, the happy go lucky bully boys were not destined to carry the day into the weekend.

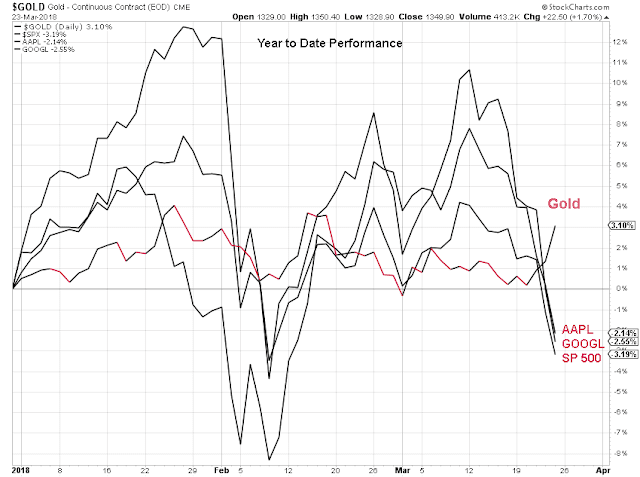

Stocks sold off rather hard, led lower by big tech and financials, especially on increasing volume into the last two hours in the close of the markets in the US.

Just as they had done yesterday. Oh my.

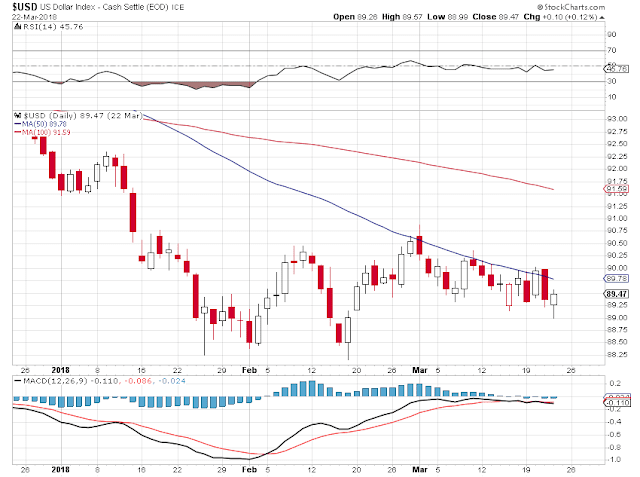

The US Dollar was weak, which was surprising for Larry Kudlow’s ‘King Dollar.’

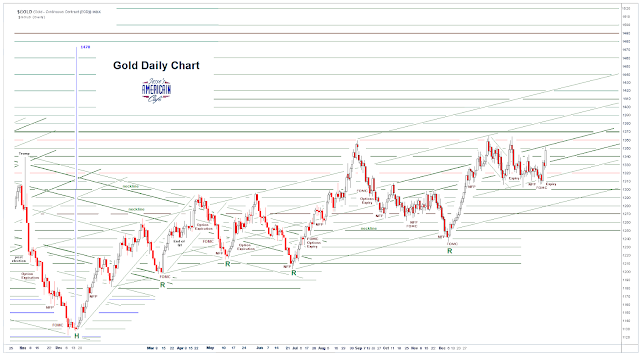

Gold and sovereign debt caught a bid, in what was definitely a flight to safety trade that was hard to miss. No idea why it did not show up yesterday, but another day of stiff selling had the punters running to escape the pain.

Few things stand up to a panic like gold, held in a manner without undue counterparty risk.

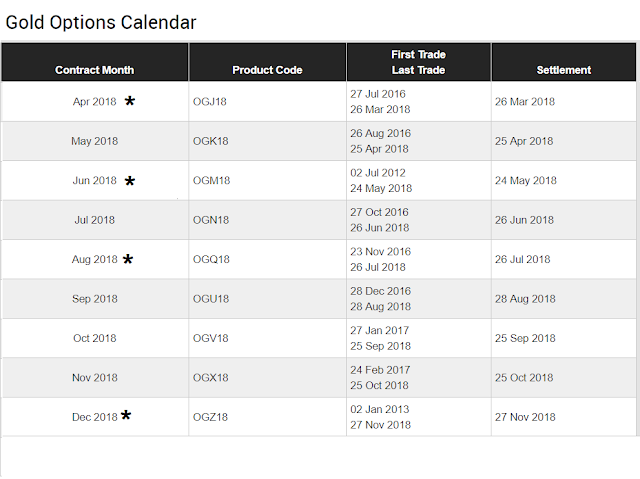

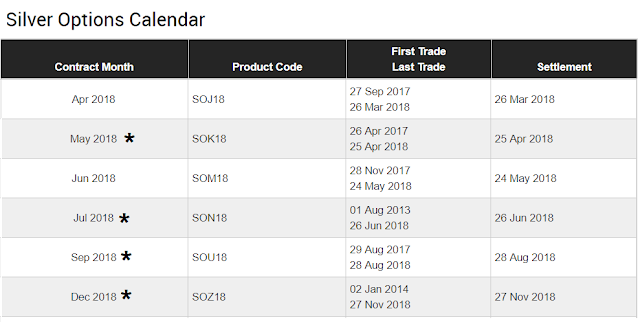

There will be an options expiration on the Comex on Monday for April gold and silver.

Trumpolini pulled a rather self-absorbed stunt by threatening to veto the Omnibus Spending Bill at the last moment before the weekend after the Congress had gone home. Especially since he and his minions were not caught by surprise by anything in it. It did stir up the market confidence a bit more, but probably played well with his base’s baser instincts.

And the band played on.

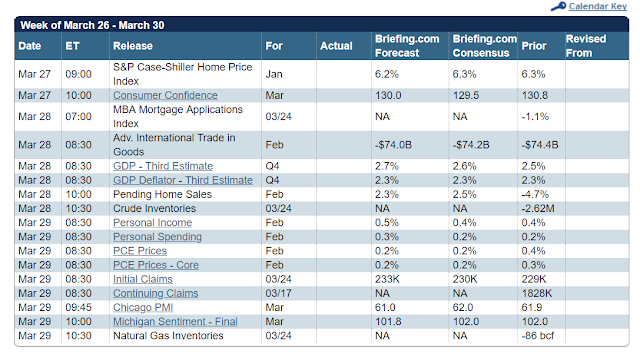

Next week should be interesting.

Leave A Comment