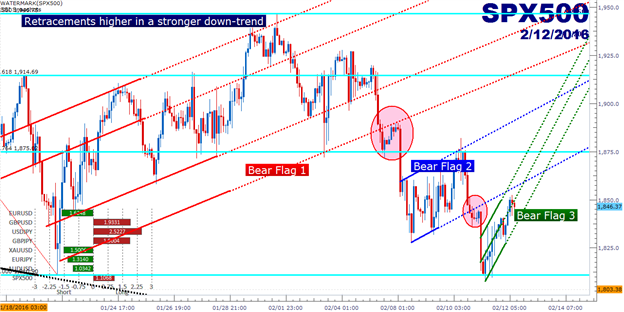

After setting fresh lows yesterday morning, we’re seeing pullback in many global equity indices. The Bear Flags from last week were soundly broken, and it appears as though we’re seeing some fresh bear-flags form. The potential for volatility for the remainder of this week is extremely elevated.

Most global indices are trading higher on the morning after a brutal week. And this was a brutal week to be sure, but outside of market moves, there wasn’t really much of note to take place. The most shocking piece of data actually came out well ahead of this week’s open when Chinese foreign reserves fell to their lowest level since May of 2012. But Chinese markets were closed this week in observance of Lunar New Year, so we didn’t even see the reaction from regulators in response to this drop, yet equity markets still pulled lower anyways. China re-opens on Monday, and it wouldn’t be out of the realms of possibility to see some action out of Chinese regulators next week in response to the most recent extension of the rout.

For now, stock prices are retracing higher after setting fresh lows yesterday. We had written about a similar scenario last week when many global indices were putting in bear flag formations. Those flags were broken really quickly and we’ve seen some outsized moves since then; and with this being a Friday after a heavy week of moves lower, it makes sense to expect some retracements as investors close up short positions.

The short-term flag on the S&P is shown below along with the previous two flag formations. I realize there is a lot going on in the chart, so if you want a better view, click on the image to get a better view.

Chart 1: SPX500 2-Hour Chart

Created with Marketscope/Trading Station II; prepared by James Stanley

These retracements aren’t relegated to just the United States. We’re even seeing some retracement in Japanese stocks after another brutal week. Since the announcement of negative rates, the Nikkei is now down by -14.9% from the highs, and this is in just a little under two weeks.

Chart 2: JPN225 Hourly Chart

Created with Marketscope/Trading Station II; prepared by James Stanley

We did get two hours and many hours of Janet Yellen’s testimony in front of Congress, but again, nothing really happened here. She hedged her statements fairly well and didn’t make any commitments to anything.

The one theme that did appear to transpire in response to Ms. Yellen’s Congressional performance was a continued hit to 2016 rate expectations. On Wednesday, she said that she didn’t rule out negative rates for the US economy although she mentioned the legality would need to be researched. She seemed slightly more open on the topic on Thursday in which she said she wasn’t taking ‘anything’ off of the table.

Leave A Comment