Today’s miss for payrolls, drop in unemployment, weaker wage growth, and drop in the participation rate was proclaimed by Bob Pisani and his like as “goldilocks”… David Rosenberg disagreed:

My grade for today’s payroll report is a big fat C-. Harsh, yes, given the apparent good news in the 3.9% u-rate, but this does not reflect job market strength as much as the symptom of an ever-depleted pool of labor (11-year low).

— David Rosenberg (@EconguyRosie) May 4, 2018

But for now, stocks ended the week unchanged thanks to the biggest short squeeze since Brexit to reassure everyone that…

Video length: 00:02:44

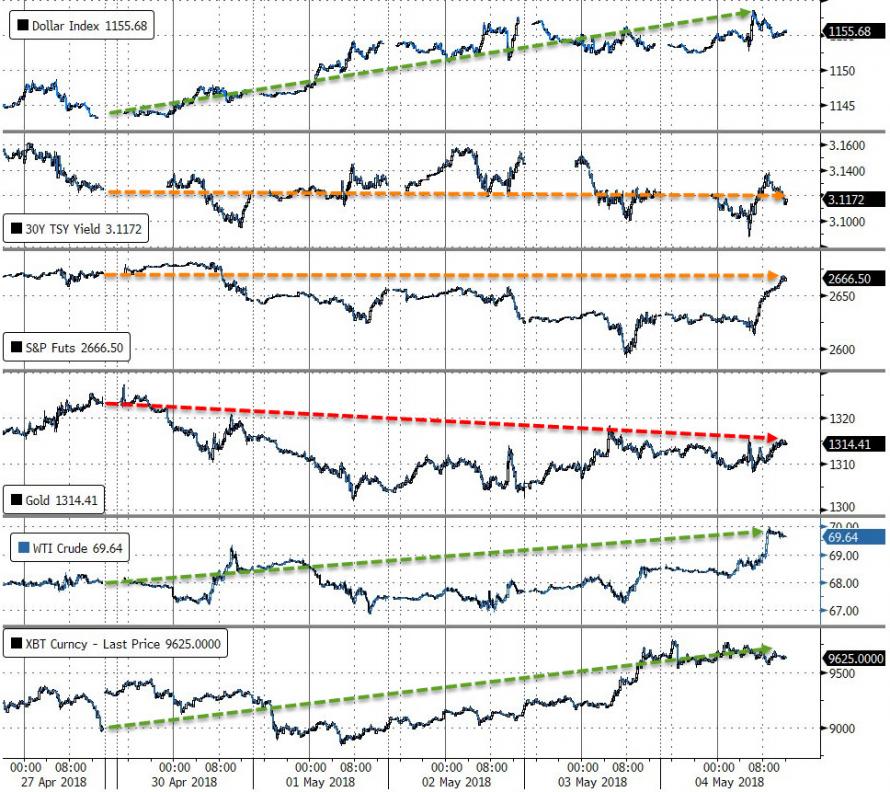

On the week, stocks mixed (Nasdaq up, Dow down); Dollar, Oil, and Bitcoin up; Gold down, bonds unch…

Friday saw Thursday’s momo reversal extend with Nasdaq and Small Caps squeezed into the green for the week and then S&P and The Dow pumped to green for the week after Fed’s Williams comments that he’s ok overshooting 2% inflation for a while… but by the close only Nasdaq and Small Caps held gains on the week…

Futures show this was not related to payrolls – this was pure cash market short squeeze that began as Europe closed yesterday…

Of course the yuuge bounce is all technical – Dow and S&P bouncing off their 200DMA

Today was a huge 3.3% “Most Shorted Stock” short-squeeze day…

The biggest single short-squeeze day sine 6/29/16 (the post-Brexit buying panic bounce)

VIX flash-crashed to a 10-handle as payrolls printed…

and closed with a 14-handle for the first time since March 9th (payrolls day!)… and look what happened right before that low?!

Big Bank stocks ended the week red despite today’s effort to ramp… (SocGen, BNP, and HSBC all missed this week)

Leave A Comment