Stocks Rally Despite Headline Risk

The stock market has been amazingly resilient in the past few days as the S&P 500 is only down about 1.2% from the all-time high despite the increased threat of nuclear war with North Korea and the devastating storm in Texas which brought catastrophic flooding. It’s possible 500,000 homes were destroyed along the Gulf Coast. Some traders are joking that investors are afraid to sell even at the threat of nuclear war. It’s a market which is benefiting from loose financial conditions, improvement in emerging market economies, and record earnings from the top firms. The Russell 2000 is up 1.95% year to date because small firms haven’t had the same profit growth.

Even though multinationals are doing well, you’d expect weakness to come from the hurricane as the millions of people who were affected by the storm probably won’t be buying the latest iPhone. The chart below reflects the intense optimism Americans have about the stock market. Only 20% of people expect the stock market to drop in the next 12 months. That optimism rivals what was seen in the poll in 2007 and 2000. It’s not a surprising result. Stocks rallying despite big headline risk would make most people think it can’t go down. It’s doubtful many of the people surveyed are aware of the central banks’ intervention, but they see the results: a perennially increasing market.

The chart below is the best depiction of the lack of volatility as there has now been 204 trading days without a 3% decline in the S&P 500. The market is 37 trading days away from beating the 1995-1996 record streak. When the market rallies on terrible news it makes you wonder what could cause it to fall. There is a big trend of investors putting money into ETFs which provide an endless bid for stocks. The only thing that can stop this is baby boomers retiring causing them to take their money out of stocks.

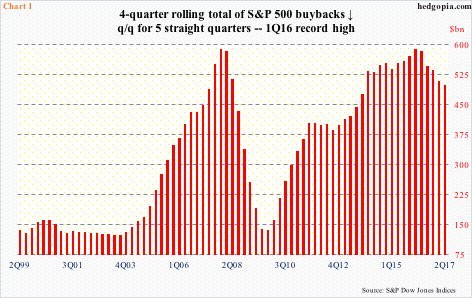

The information on buybacks is usually delayed. The chart below shows the total S&P 500 buybacks in Q2. As you can see, despite the record quarterly earnings, the total buybacks have fallen for 5 straight quarters. It’s amazing to see earnings growth improving with the lack of a boost from buybacks. Buybacks made 2015-2016 EPS look better than it was and now it’s dragging down 2017 EPS. While 2018 will have tough comparisons, an increase in buybacks will be a tailwind for EPS. The bears like to describe this weakness as a catalyst for the end of the bull market, but it’s simply a trailing indicator for earnings. It’s impressive to see stocks avoid a selloff when the biggest buyer of stocks this cycle has taken a dip. As you can see, the peak in 2016 was near the 2007 peak, but this elevated level has existed for longer. It’s a new trend which started last cycle. Buybacks return capital to shareholders, but they might not be great for the economy as the lack of fixed investment has hurt productivity.

Leave A Comment