But “hawkish” was “bullish”?

Roughly translated….

A Week of turmoiling…

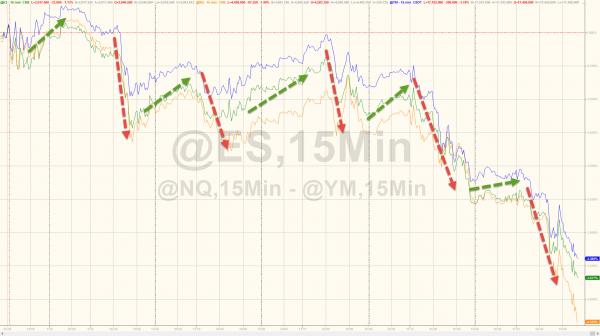

Futures markets show a clear pattern throughout the week of US session weakness and overnight recovery…

Nasdaq closed very ugly on the day…

Which left Small Caps worst but everything red for the week…

Retail pukefest…

FANG FUBAR since FedSpeak began…

TWTR back below its IPO price…

And Camera-on-a-stick below its IPO price…

Eveything is red since FOMC…

Financials and Energy wewre ugly this week….

As financial stocks catch down to credit once again…

Stocks year-to-date…

Once again “123” was the number that mattered… As soon as Europe closed, USDJPY ramped to 123.00 dragging S&P Futures with it… and then rolled over…

Trannies caught down to Crude once again…

Stocks are catching down to credit…

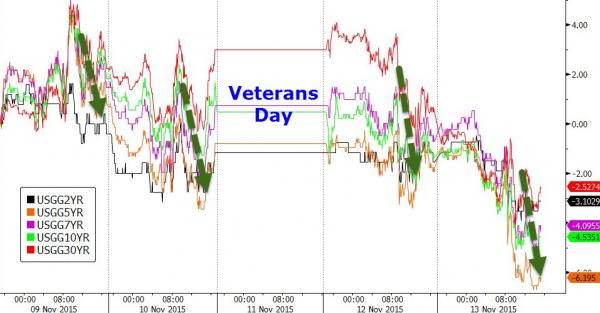

Treasury yields closed down notably on the week after consistent early selling and late buying… (with today’s rally the biggest of the week)

The dollar ended the week modestly lower against the majors…

Commodities were a bloodbath this week…notice the similar pattern in the USD and crude…

Gold closed lower for the 4th week in a row – lowest weekly close since Jan 2010…

Crude carnage…

Charts: Bloomberg

Leave A Comment