Stocks Fall Sharply On Monday

There was a steep decline on Monday, which pushed the S&P 500 towards the lower end of the range it has been in for the past few weeks. The S&P 500 was down 1.42% and the Nasdaq was down 1.84% because Facebook’s 6.8% decline dragged it down. Even though the market doesn’t appear to react to most economic reports immediately, I still think part of the stagnation in stocks is because February was a weak month. March will include, what looks like, 4 winter storms for the northeast which lessens its importance.

Labor Market Not At Full Employment

The economy is creating excess jobs compared to the population growth, so the labor market is strong. The 13-month average jobs growth is 191,000. To keep up with population growth, the economy needs to create 80,000-100,000 jobs. That average job growth would signal the labor market is at full employment. The stagnant wage growth, high job growth, and increased labor participation rate all signal the economy isn’t at full employment. Even with this job growth, the retail sales results were weak. The industrial economy is strong, but it’s too small of a part of the economy to keep the economy running at its potential growth rate.

Other Markets Were Placid

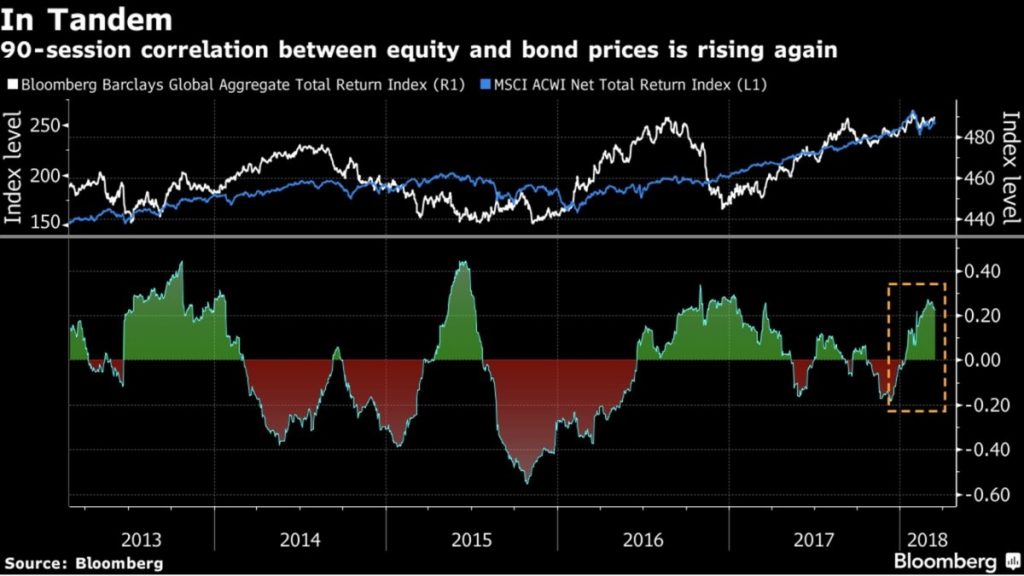

The 10-year bond yield was up 1 basis point to 2.85%. The 10 year minus 2-year bond is still at 55 basis points. In the past few weeks, we’ve seen the yield curve steepen when stocks sold off, but today there wasn’t much movement in bonds. The chart below shows the 90-day correlation between equity and bond prices. The latest relationship is positive, but it’s too volatile to expect that relationship to remain consistent. The dollar index was also flat and WTI oil fell 28 cents, furthering the point that it was equity-focused volatility on Monday.

GOP Looks Towards Phase 2 Of Tax Reform

Don’t get preoccupied by Trump’s tweets. The media acts like every tweet moves the markets just because a couple important ones were sent in regards to the tariffs. Politically, they may be important, but they don’t affect stocks. It will cost you money if you focus on politics while you are trading and investing. According to the Investor’s Almanac, the best political situation is a Republican Congress and a Democratic President, but that hasn’t played out in the past year as both the President and Congress are Republicans and stocks have rallied. There is only a small group of new events in politics which effect stocks. They are the following: the tariffs, the trade agreements, any debt ceiling or budget issues, the Dodd-Frank repeal bill (and other regulatory cuts), and the potential tax reform legislation.

Leave A Comment