It’s safe to say that the market is pricing in some kind of political risk around the administration’s highly contentious decision to end DACA.

This was, of course, predictable (both the rescinding of the program and the political firestorm it will invariably engender), but this looks like a bridge too far for U.S. equities that are still catching up in terms of pricing in North Korea after the holiday weekend.

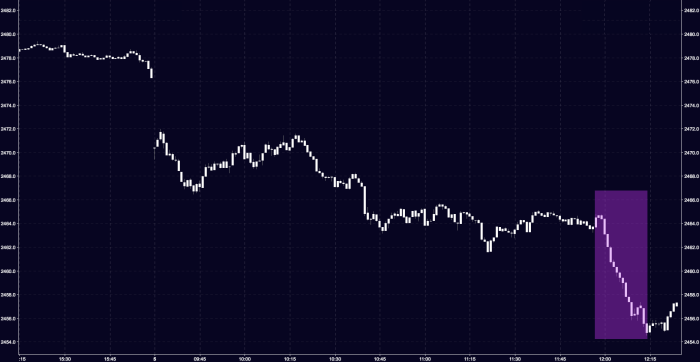

Here’s the S&P:

Same thing in the Nasdaq:

And VIX to session highs:

This seems to have really accelerated as Trump’s official statement hit..

JUST IN: Pres. Trump releases statement on decision to end DACA: “It is now time for Congress to act!” https://t.co/m6wf96tR97 pic.twitter.com/qEQWh9GBcT

— ABC News Politics (@ABCPolitics) September 5, 2017

Bottom line – as Bloomberg’s Michael Regan correctly notes – it’s just too much:

The situation in equities has deteriorated noticeably: the Dow is down more than 200 points, the VIX is up by 3 vols, yields remain at lows of the day and the dollar remains weak. We haven’t seen any fresh news to account for the worsening drop in stocks, but when you add up all the day’s headlines there is quite a gauntlet of worries for the market to get past at the moment.

Leave A Comment