Terrible economic news is wonderful news for markets, all over again, and with the worst S&P 500 quarter since 2011 set to close today, some horribly “great” news is just what the window-dressing hedge funds, most of whom are deeply underperforming the broader market (not to mention Dennis Gartman) ordered.

Days after Japan returned to deflation for the first time since 2013, confirming Abenomics 1.0 was a failure (hence Abe’s launch of Abenomics 2.0 which will be even worse)…

… and after reporting even more abysmal industrial production and retail sales data, which in turn prompted a bevy of banks to cut their Q3 GDP forecasts to negative (JPM now expected Q3 GDP of -1.0%) and unleash yet another technical recession for Japan, the fifth since the financial crisis, the Yen plunged following the latest round of loud, renewed calls for a boost to the BOJ QE, and JPM in fact made the October 30 BOJ meeting its base case for further central bank easing. Abe advisors Honda and Takenaka both confirmed more BOJ easing is just a matter of time, as a result pushing the USDJPY solidly above the market critical 120 level.

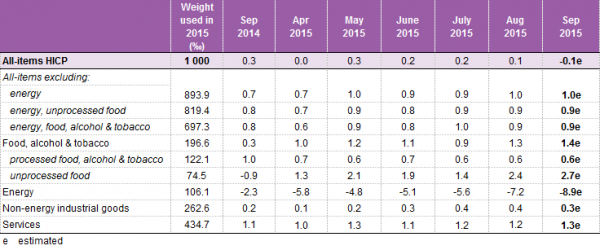

And then, just a few hours later, we got the latest inflation, or rather deflation, data out of Europe, where consensus hoping for an unchanged print was once again disappointed when the September CPI print came in negative once again on the back of a drop in commodity prices, confirming the latest inflationary impulse from the March launch of QE is officially over.

As a result of Europe’s relapse into deflation, hours ago S&P announced that it believes the ECB will more than double its QE program from €1.1bn to €2.4 bn: “We believe the ECB will extend its QE program beyond September 2016, most likely until mid-2018, and that it could reach €2.4 trillion–more than twice the original €1.1 trillion commitment.”

Nothing new here, just more people piling onto the more stimulus train before this too fail, and the now inevitable monetary paradrops begin.

Finally, jumping on board the “moar stimulus” train, was China which whose central bank and banking regulators just announced today that down payment requirement for first mortgage will be lowered from 30% to 25%, while additionally China would also cut in half the taxes on small car purchases in a bid to stimulate its sputtering auto market. How this latest attempt to reflate the previously burst housing bubble will help the proper allocation of capital is anyone’s guess, but for now markets are loving this trifecta of “bad news is good news” from around the globe, even as such “hawks” as Bill Dudley and Janet Yellen are set to speak later today in the US.

Looking at markets it was blast off from the beginning entirely on the back of the diagonal move in the USDJPY: Asian equity markets traded mostly higher as they rebounded from yesterday’s substantial declines. The Nikkei 225 (+2.7%) recovered from 8-month lows and yesterday’s 4% slump, to return back above 17,000 as JPY softened, while the ASX 200 (+2.1%) was lifted by strength in large banks. Shanghai Comp. (+0.5%) was supported by gains in the auto sector, after China announced it is to halve taxes on small car purchases. JGBs tracked the losses seen in USTs on the last day of fiscal H1 trade amid gains in equities with investors side-lined until tomorrow’s 10yr auction, while the BoJ entered the market to purchase JPY 1.18trl as expected.

Equities in Europe traded higher since the open (Euro Stoxx: +2.4%), largely in reaction to stock specific news flow, which in turn meant that Bunds traded lower, albeit marginally. Glencore (+11.0%) shares surged as it continued to reaffirm that it is financially sound, while VW (+2.7%) shares advanced in reaction to reports that China is to halve taxes in small car purchases, together with WSJ reports, which suggested that the company could avoid criminal prosecution. At the same time, shares of UK retailer Sainsbury’s jumped over 10% after it said full-year profits were set to be better than expected.

Leave A Comment