Some investors transitioned from a “fear of missing out” (aka FOMO) at the beginning of the year to a worry that things are now “as good as it gets” – meaning that the market is in its last bullish move before the inevitable downturn kicks in. And now, escalating trade wars and a flattening yield curve have added to those fears. However, it appears to me that little has changed with the fundamentally strong outlook characterized by global economic growth, strong US corporate earnings, modest inflation, low real interest rates, a stable global banking system, and historic fiscal stimulus in the US (including both corporate tax cuts and deregulation). Moreover, the Fed may be sending signals of a slowing of rate hikes, while great strides have been made in reworking trade deals.

Many followers of Sabrient are wondering why our Baker’s Dozen portfolios – most of which had been performing quite well until mid-June – suddenly saw performance go south even though the broad market averages have managed to achieve new highs. Their concerns are understandable. However, if you look under the hood of the S&P 500, leadership over the past three months has not come from where you would expect in a robust economy. An escalation in trade wars (moving from posturing to reality) led industrial metals prices to collapse while investors suddenly shunned cyclical sectors in favor of defensive sectors in a “risk-off” rotation, along with some of the mega-cap momentum Tech names. This was not a healthy behavior reflecting the fundamentally-strong economy and reasonable equity valuations.

But consensus forward estimates from the analyst community for most of the stocks in these cyclical sectors have not dropped, and in fact, guidance has generally improved as prices have fallen, making forward valuations much more attractive. Sabrient’s fundamentals-based GARP (growth at a reasonable price) model, which analyzes the forward estimates of the analyst community, still suggests solid tailwinds and an overweight in cyclical sectors. Thus, we expect that investor sentiment will eventually fall in line and we will see a “risk-on” rotation back into cyclicals as the market once again rewards stronger GARP qualities rather than just the momentum or defensive names. In other words, we think that now is the wrong time to exit our cyclicals-heavy Baker’s Dozen portfolios. I talk a lot more about this in today’s commentary.

Of course, risks abound. One involves divergent central bank monetary policies, with some continuing to ease while others (including the US and China) begin a gradual tightening process, and the enormous impact on currency exchange rates. Moreover, the gradual withdrawal of massive liquidity from the global economy is an unprecedented challenge rife with uncertainty. Another is the high levels of global debt (especially China) and escalating trade wars (most importantly with China). Because China is mentioned in every one of these major risk areas, I talk a lot more about China in today’s commentary.

In this periodic update, I provide a market commentary, offer my technical analysis of the S&P 500, review Sabrient’s latest fundamentals-based SectorCast rankings of the ten US business sectors, and serve up some actionable ETF trading ideas. In summary, our sector rankings now look even more strongly bullish, while the sector rotation model retains its bullish posture.

Market Commentary:

Impact of trade wars on Sabrient’s GARP portfolios:

First let me speak to recent market conditions because investor sentiment is not as confident as the recent all-time highs make it seem. A strong 2017 carried over into January, led by the momentum factor and growth stocks, reflecting brimming business, consumer, and investor confidence in synchronized global economic growth and the massive potential presented by fiscal stimulus here at home. Most of Sabrient’s cyclicals-heavy portfolios thrived during this period. But then February brought about an overdue correction on fears of rising inflation and stock valuations getting ahead of themselves, and market behavior hasn’t been quite the same ever since, as trade war rhetoric has kept investors jittery and sector correlations rose from around 50% to roughly 80% (reflecting more in the way of risk-on/risk-off behavior).

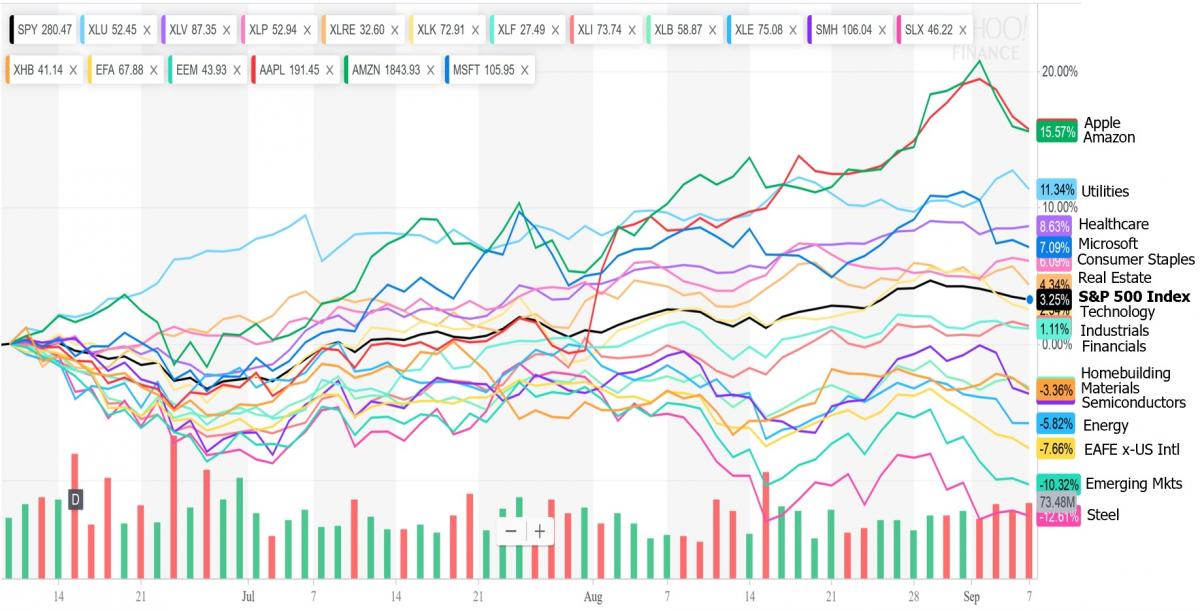

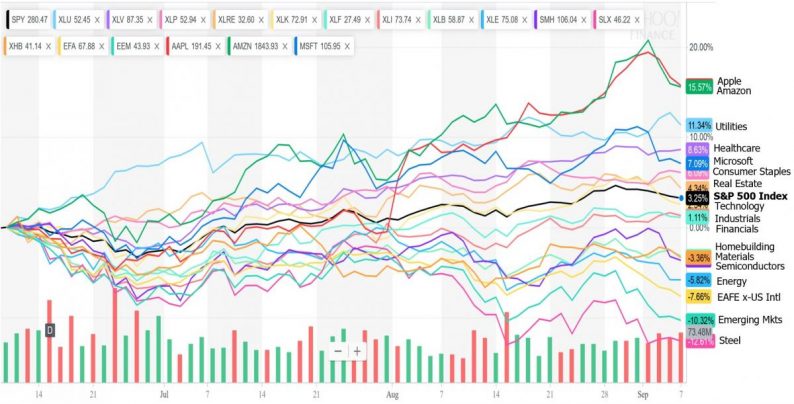

And then on June 11, the sudden escalation in trade wars (when President Trump announced a 25% tariff on $50 billion of Chinese imports) led investors to take profits in the cyclical sectors (e.g., Industrials, Materials, Steel, Homebuilding, Energy, Financials, Semiconductors) and rotate capital into the defensive and dividend-paying sectors (e.g., Utilities, Healthcare, Real Estate, Consumer Staples) and the low-volatility factor, along with a few mega-cap momentum Tech names that include the three largest holdings in the S&P 500: Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN). Notably, those three companies account for almost half of the S&P 500’s return since June 11, and two of them (AAPL and AMZN) recently reached $1 trillion market caps.

You can see the rotation since June 11 among various sector ETFs and mega-cap Techs in the chart below, as well as a similar risk-off divergence in the relative performance of international markets represented by the iShares MSCI EAFA ETF (EFA) and the iShares MSCI Emerging Markets ETF (EEM):

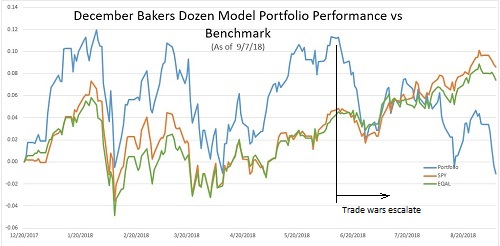

Meanwhile, Sabrient’s quantitative GARP model has pointed us toward the cyclical sectors, as you would expect in a robust economy. Our December Baker’s Dozen launched late in December, so it can help serve to illustrate the 2018 YTD performance of our models, and you can see in the chart below the sudden performance downturn starting on June 11 coinciding with the escalation in trade wars. (Note: it shows gross price performance of our Model Portfolio, not the net return of the UIT portfolio that seeks to track it.)

If you believe that US and global economies are strong and growing, then cyclicals (and our portfolios) are likely only temporarily underperforming. But for now, our pronounced sector tilts away from the benchmark’s allocations have magnified the impact on relative performance. The S&P 500 benchmark has been able to hold up better (and even move to new highs) due to three key aspects: 1) a high (26%) sector allocation to the Technology sector, which our GARP model has not been favoring lately as much as it did in prior years; 2) persistent strength in mega-cap momentum names like AAPL, MSFT, AMZN, which are its 3 largest holdings; and 3) the ability to retain investment capital while temporarily rotating internally into defensive sectors like Utilities, Healthcare, Real Estate, and Consumer Staples.

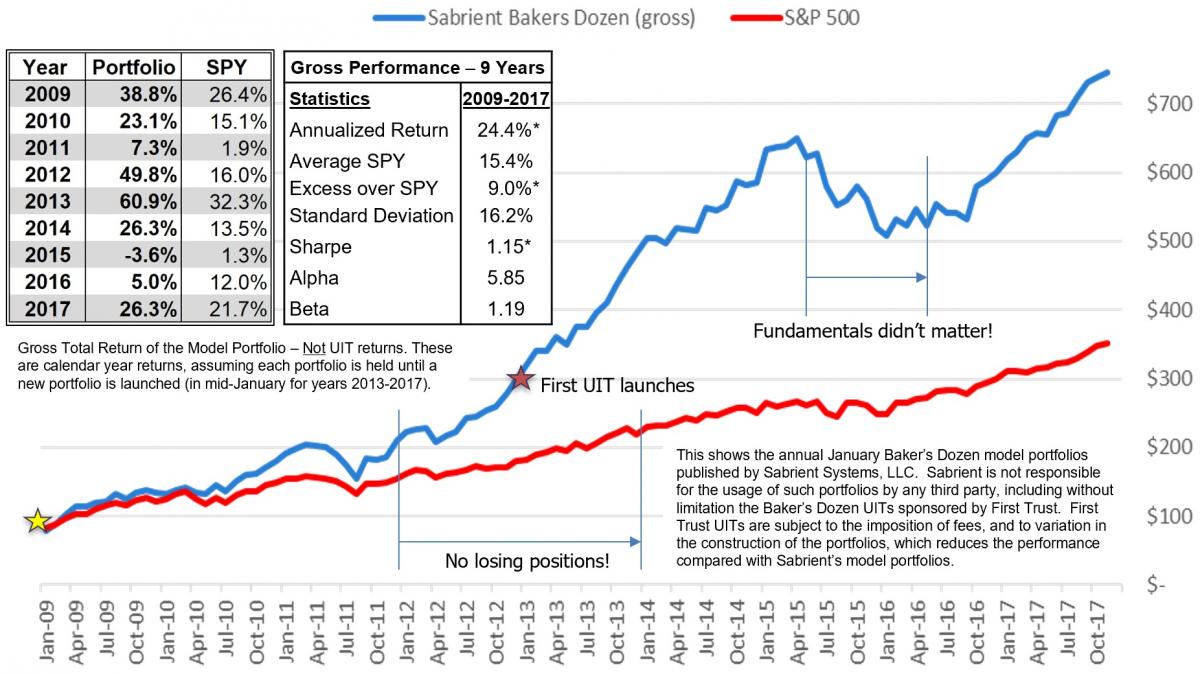

Sabrient’s concentrated Baker’s Dozen portfolios are designed to offer strong potential for alpha versus the broad market, but they also can display higher volatility – especially given sector tilts away from the benchmark. But this current performance divergence (extreme as it may be) certainly does not lead me to lose confidence in the long-term performance of Sabrient’s disciplined bottom-up process, which continues to be run by founder David Brown and the combined Sabrient/Gradient analyst team. History shows that when the market is rewarding fundamentals (rather than simply reacting to the news stream in risk-on/risk-off behavior), our GARP approach tends to work quite well. The chart below shows the long-term gross performance of our annual January Model Portfolio, 2009-2017, going into this year:

The main periods of underperformance were in 2H2011 and the 12-month timeframe 2H2015-1H2016, during which the market was news-driven rather than fundamentals-driven. You can find more information, including the specific holdings of each historical January portfolio, as well as the new monthly Baker’s Dozens, on our public website: http://bakersdozen.sabrient.com.

Of course, if the sell-side analyst community were to slash estimates in the cyclical sectors due to a change in outlook, that would certainly impact our quant rankings. But that has not yet been the case, as the consensus forward estimates from the analyst community for most of the stocks in these cyclical sectors have not dropped, and in fact, guidance has generally improved as prices have fallen, making forward valuations much more attractive. And with fiscal stimulus boosting what I think is a mid-cycle economy that seems ready to finally ramp into a boom phase, cyclicals remain the place to be overweight, according to our model.

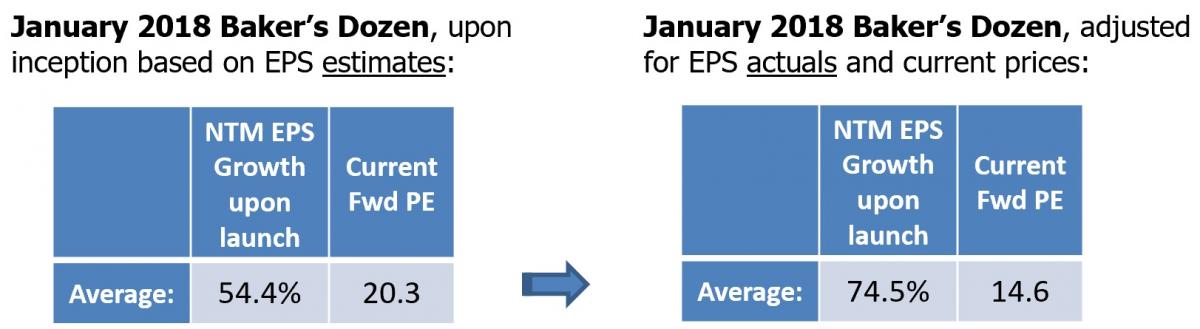

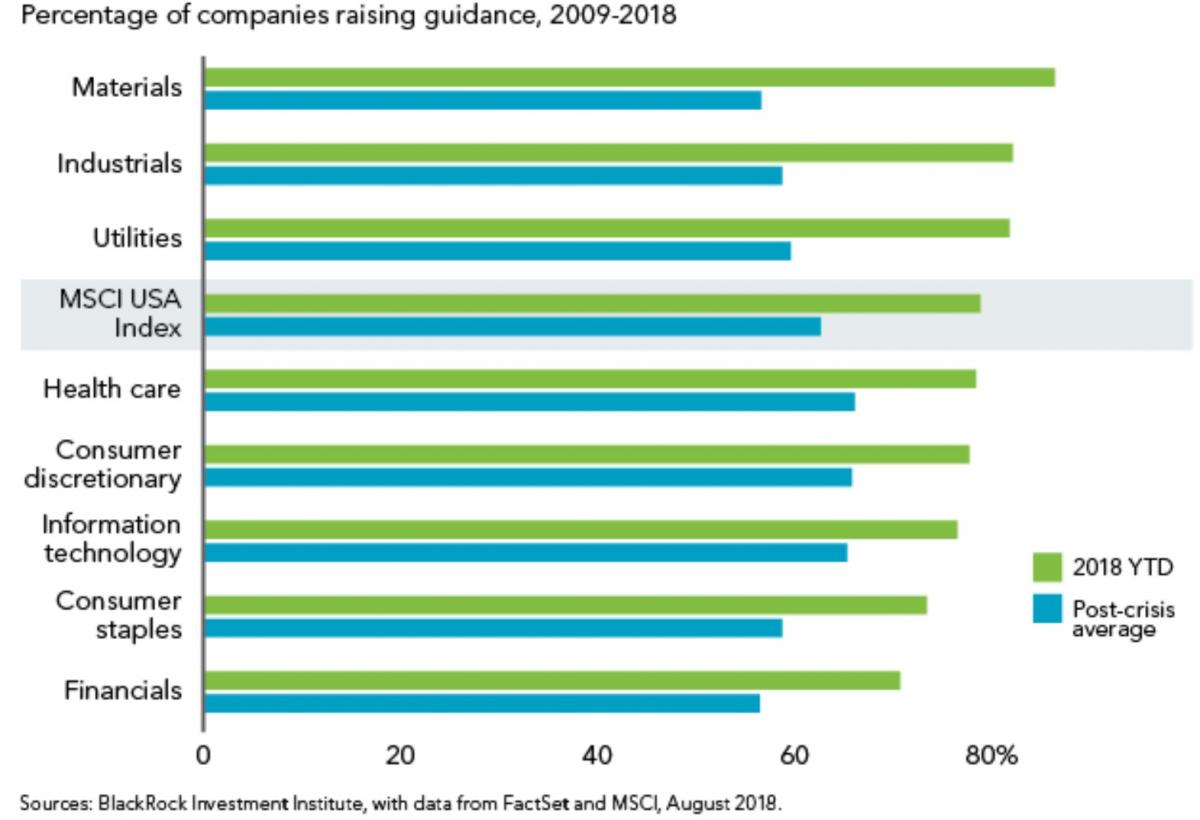

Indeed, the tables below show how much better the EPS growth for next 12 months (NTM) and forward P/E ratio are when we replace the original estimates for Q1 and Q2 with actual reported EPS numbers for the January Baker’s Dozen stocks, along with current prices. In addition, the second graphic published by BlackRock shows that Materials and Industrials companies have been raising guidance this year much more than the post-Financial Crisis average, despite the trade wars. Unless guidance suddenly weakens significantly and the analyst community slashes forward estimates, we fully expect these stocks to recover, as their numbers are just too good.

So, forward valuations for our Baker’s Dozen stocks appear to be much more attractive. And with fiscal stimulus boosting what I consider to be a mid-cycle economy that finally seems ready to ramp into a long-awaited boom phase, cyclicals remain the place to be overweighted, according to our model. We have great optimism that as strong earnings reports continue to roll in, if forward guidance remains solid and the trade wars are resolved (especially with China), investor sentiment will fall in line and we will see a risk-on rotation back into cyclicals as the market once again rewards stronger GARP qualities rather than just the momentum or defensive names. In fact, if you look closely at the December Baker’s Dozen performance chart above, the brief but significant performance upturn in mid-August – after the announcement that talks with China had resumed – may have provided a glimpse of that potential.

Leave A Comment