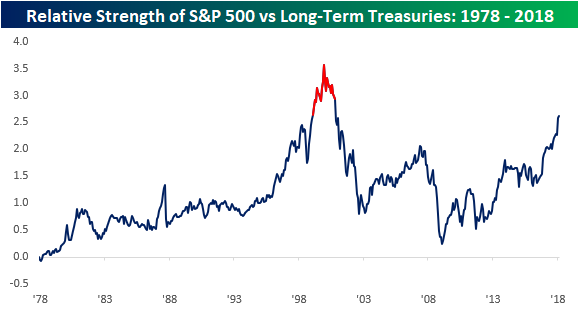

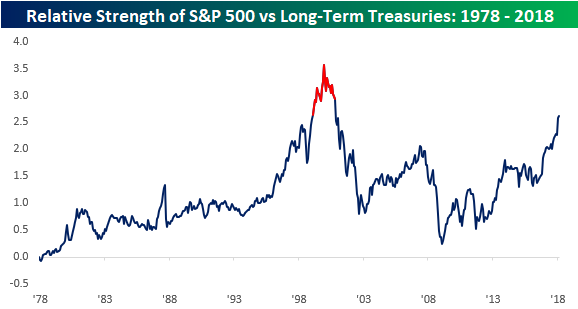

With investors celebrating the nine-year anniversary of the financial crisis low last week, it should surprise no one that equities have been outperforming long-term treasuries over the last several years. What will likely surprise a lot of people is by just how much equities have been outperforming. The chart below shows the relative strength on a total return basis of stocks (S&P 500) vs bonds (Merrill Lynch 10+ Year US Treasury Index) going back to the start of 1978. In the chart, a rising line indicates that equities are outperforming bonds and vice versa.

Since the middle of 2016, the relative strength of the S&P 500 has gone practically parabolic as equities have surged and interest rates have risen. Equities are outperforming by such a wide margin right now, that there have only been 21 other months going back to 1978 where the performance disparity was wider than it is now, and all of those months were in the period from February 1999 through October 2000. Back in 2000, once that period of equity outperformance came to an end, Treasuries consistently outperformed equities for ten years right through to February 2009. Since then, it’s been a nine year run for equities, with little in the way of looking back.

Leave A Comment