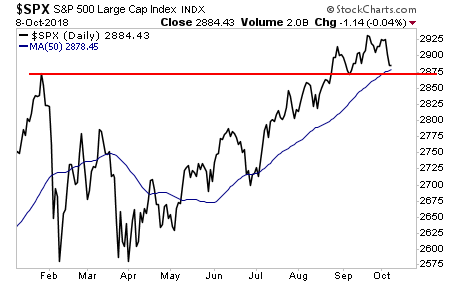

Last week’s breakdown caused considerable technical damage to the bull market in stocks. We are now at the proverbial “line in the sand” at which stocks MUST bounce or the bull market is OVER.

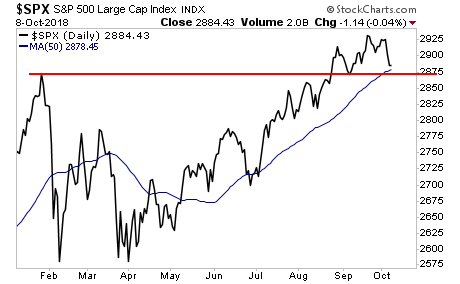

The S&P 500 has both its 50-Day Moving Average (DMA) and critical support from the January 2018 top just below current levels.

This is a MAJOR confluence of support here. If the S&P 500 CANNOT hold this level, then it’s GAME OVER for the bull market in stocks.

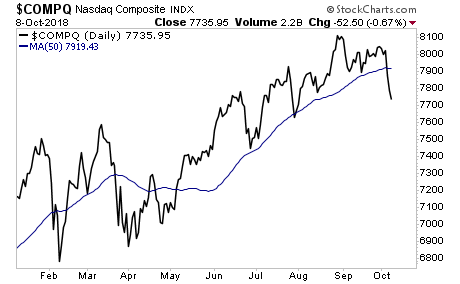

Unfortunately it’s not looking good. The Nasdaq, which has lead the broader market during the rally, has already collapsed well below its comparable levels.

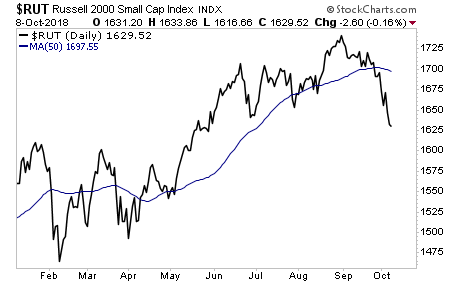

The picture is even worse for the microcap index, the Russell 2000.

Did the next crisis just start? We are about to find out!

Leave A Comment