Thoughts

1 am: More than 80% of U.S. IPO’s lose money. Why this isn’t a bearish sign for the stock market.

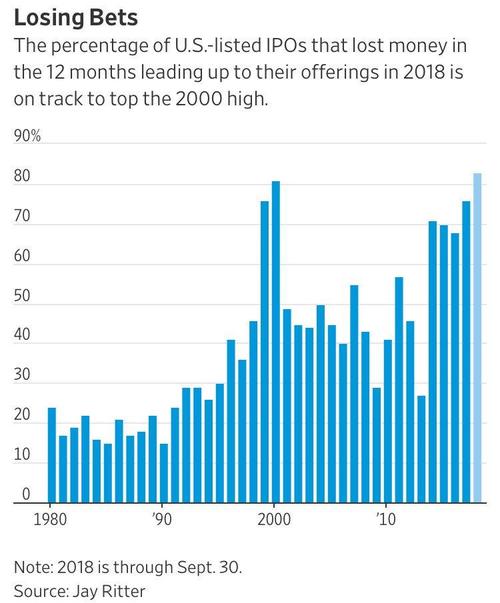

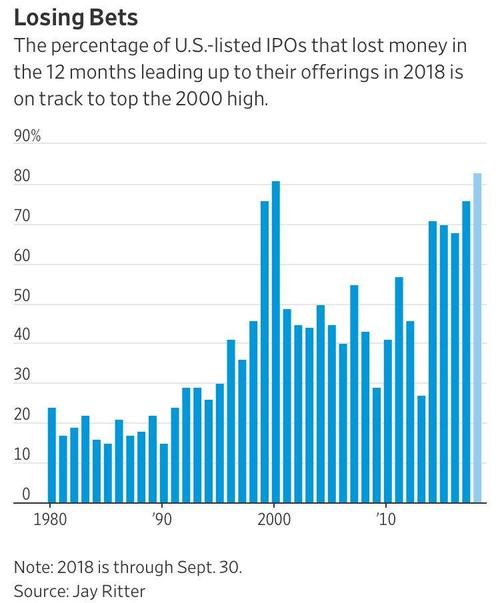

The Wall Street Journal’s latest data demonstrates that more than 80% of U.S. PO’s lost money in the 12 months leading up to their IPO’s this year. This is on part with 2000 (at the height of the dot-com bubble).

Some traders see this as a sign of exuberance. I don’t.

Something has changed. As you can see, this figure has been consistently high for 5 years in a row now. More and more IPO’s are tech companies, and tech companies generally try to figure out how to make money AFTER they IPO.

With that being said, this is definitely late-cycle behavior. But it doesn’t tell you anything about WHEN the stock market will peak.

1 am: Durable goods continues to trend higher. This confirms the bull market’s rally.

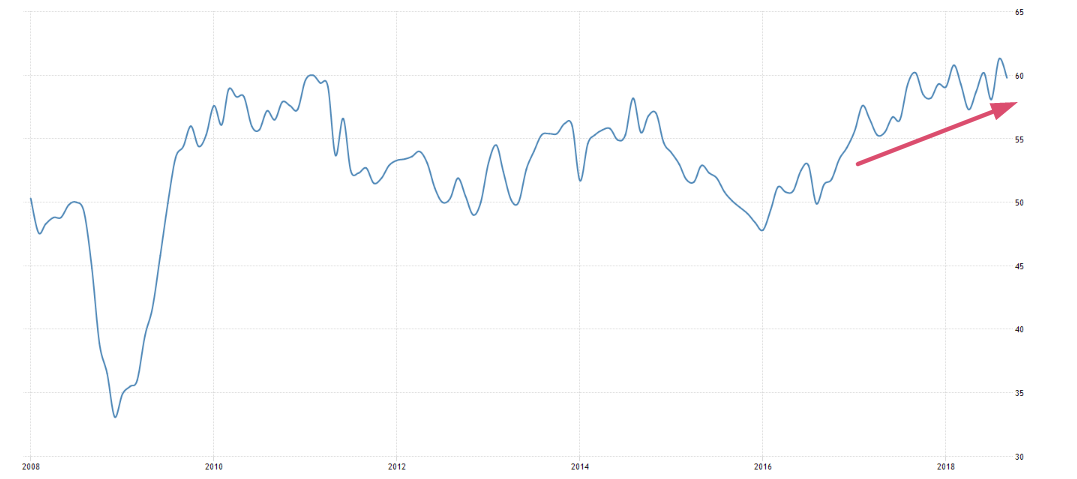

The latest reading for Durable Goods demonstrates that this data series is still trending higher.

This confirms the stock market’s rally. Historically, Durable Goods is a coincident indicator for the economy and stock market (Durable Goods, the stock market, and economy trend higher and lower together).

1 am: ISM Manufacturing is fell a little but is still trending higher. Medium term bullish for stocks.

The latest reading for ISM Manufacturing fell a little from its previous reading. However, the key point is that ISM Manufacturing is still trending higher.

This is a medium term bullish sign for the U.S. stock market. ISM Manufacturing is a leading indicator. Historically, ISM Manufacturing trends downwards before a bear market or recession begins.

Leave A Comment