Another day, another record high in markets around the globe as stocks – contrary to what Jeremy Grantham expects – have already entered the blow-off top mania phase. U.S. equity index futures rise, following a jump in European and Asian shares, while the Nikkei exploded higher after being held back for the past two days by holidays. Base metals and the euro gain.

European stocks rose the most in over two weeks on an acceleration in risk euphoria and sign the global economic expansion of 2017 remains intact. European bourses (Eurostoxx 50 +0.8%) trade higher across the board with all ten sectors in the green, as builders and automakers lead the advance. Gains are relatively broad-based with the exception of consumer staples which trades relatively flat, financials supported post-FOMC minutes. Today has seen a turn in sentiment for UK retail names with Debenhams (tumbling -17.7%) taking the shine off the sector after a disappointing sales update which saw the Co. cut their guidance.

Confirming Europe’s upward economic momentum, Markit reported the best EU Composite PMI since February 2011, printing at 58.1, above last month’s 58.0 and the expected 58.0. The breakdown as follows:

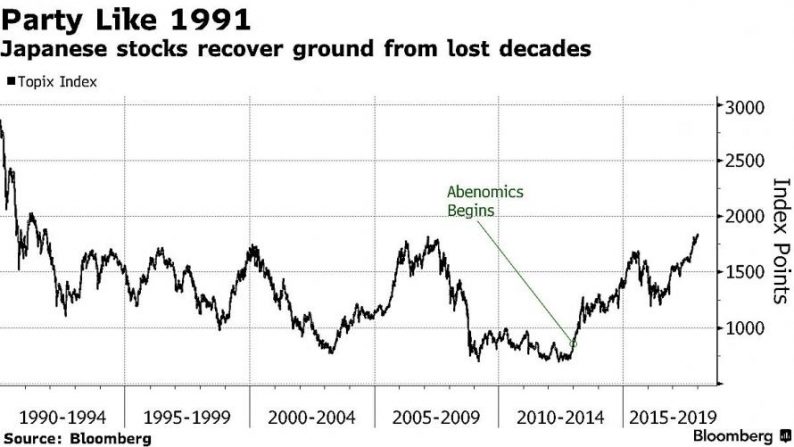

Earlier, the MSCI Asia Pacific Index headed for another record close after benchmarks in Tokyo closed at their highest in more than a quarter-century, and posting their biggest one-day gains since November 2016. Japanese investors returned to the market after two extra days of holidays for the first time this year, catching up to the rest of the global euphoria with the Nikkei 225 closing up 3.3%, boosted by tech firms and banks, the best annual opening day since 1996 while the Topix index (+2.6%) closed at its best level since 1991 as brokers and oil & coal lead gains in all 33 industry groups.

In macro, the dollar slipped and U.S. Treasuries declined as minutes of last month’s Federal Reserve meeting showed policymakers continue to back a “gradual approach” to raising interest rates.

The USD unwound post FOMC minutes gains and reversed course, with the DXY trading below the 92.00 level with EUR/USD moving higher in the wake of another set of relatively strong PMI figures. The composite PMI rose to its highest level since February 2011 as Germany rose to its highest level in 80 months. AUD/NZD/CAD are all back in the ascendency vs the Greenback, with AUD/USD absorbing at least some 0.7850 offers overnight on the back of China’s services PMI beat and another rise in iron ore prices. The Kiwi has reclaimed the 0.7100 handle having tested, but not clearly breaching key tech DMAs around 0.7105-0.7100 yesterday despite a short dip below the big figure. USD/CAD still drawn to 1.2500 amidst a range up to circa 1.2550, with the Loonie supported by firm crude prices.

Core European bonds pared Wednesday’s gains and the euro advanced toward a three-year high as data showed economic activity in the euro-area accelerated to the fastest pace in almost seven years. US Treasury yields were supported as traders lifted the odds of a Fed move by end-March, gains were limited as the minutes from the Dec. 12-13 policy meeting still lacked any explicit signal of a move in the first quarter, with some officials reiterating their concern about low inflation. “There was no suggestion that the Fed is beginning to feel concerned over the possibility of falling behind the curve,” said Lee Hardman, a currency analyst at MUFG, in a client note. “There appears to be a high hurdle for the Fed to deliver a faster pace of rate hikes beyond their current plans for three hikes in 2018. As a result, we continue to believe that the U.S. dollar will struggle to reverse last year’s weakening trend.”

Meanwhile, commodities extended a record run of gains as oil climbed from the highest close in three years. As shown in the chart below, commodities are enjoying a record run of gains that straddles the end of 2017 and the start of the new year as crude oil notches multiyear highs and investors bet that booming global manufacturing output will help to sustain rising demand for raw materials.

The Bloomberg Commodity Index, which tracks returns on 22 raw materials, posted an unprecedented 14 days of gains to Wednesday, closing at the highest since February. Bloomberg notes that the index is poised for further gains as metals and oil climb higher, supported by supply disruptions, a weaker dollar and improving demand. Palladium, a metal used in car exhaust systems, is approaching an all-time high.

The Bloomberg Commodity Index has rebounded 12 percent since mid-June. In recent days, the cold snap in the U.S., which helped to boost wheat as well as natural gas, also helping to lift the index. Still, prices remain well below the highs from 2008.

Oil climbed from the highest in three years as optimism on the global economy, cold weather and political unrest bolstered a market that’s finally shaking off a prolonged surplus. Crude is having its best start to a year since 2012, after hitting $62 a barrel in New York. Swollen inventories in the U.S. are declining and could shrink further as winter storms boost demand for heating fuel, while a strong economy underpins consumption. OPEC is continuing its fight against a global glut, while street protests are stoking concern over the stability of the group’s third-biggest producer, Iran.

Leave A Comment