Quite a week eh? “I don’t care… I want to trade size and be a big swinging dick… I’m gonna make it rain!!”

A quick summary of the week…

***

Let’s start with stocks… From worst week of the year last week to best week since October 2014’s Bullard Bounce…

Futures show the real exuberance though… Sunday night’s open marked the low after 100-plus people had been killed, and Paris was under martial law…Nasdaq +5% off Sunday night lows!!

***

The Devil’s in the Divergences…

Bonds and stocks…

Credit and stocks…

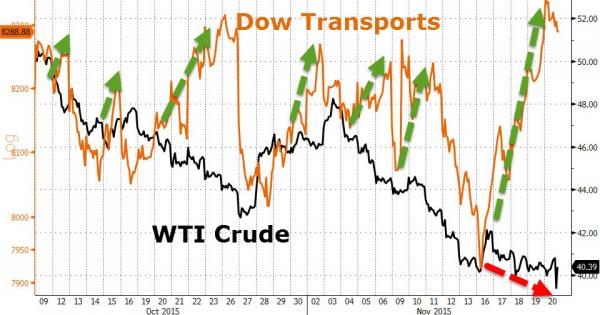

Trannies and oil…

Credit and equity risk…

Stocks and the yield curve…

And finally FX carry and stocks…

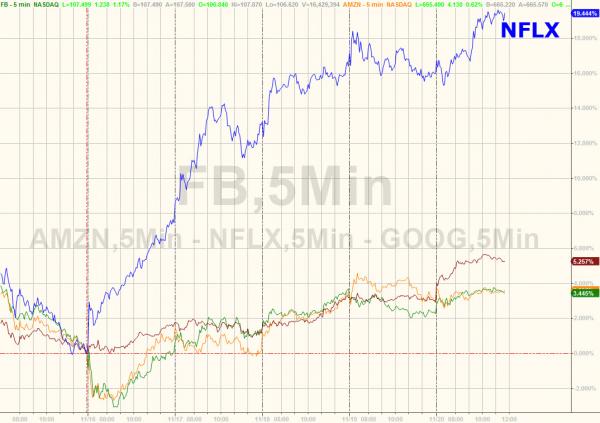

A few individual stocks mattered today…

Chipotle poisoned some folks…

Hope is high that Valeant is fixed (thanks to a Citi debt upgrade)

And then there’s Netflix!!! Up almost 20% this week!!!! An $8.6bn rise in market cap in one week… the most ever.

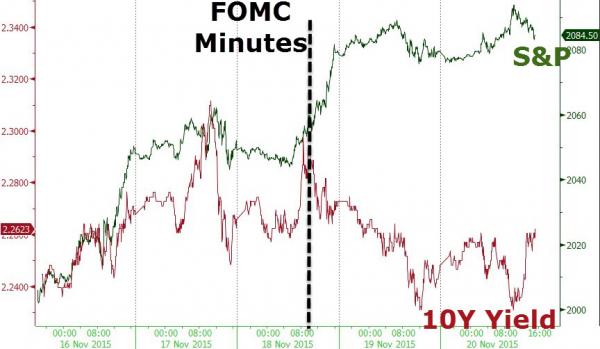

Treasury yields were extremely mixed – following FOMC Minutes – with 2Y up 8bps and 30Y -3bps on the week… 2Y highest weekly close since April 2010, 30Y yields lower for 2 straight weeks first time since August…

For the biggest flattening in 4 months – 2s30s fell 12bps this week – almost to 7 month flats…

Credit markets have now fallen 14 days in a row…

The USDollar gained on the week – Draghi’s whatever it takes today trumping odd post-FOMC weakness yesterday in the USD – AUD shot up this week…

Leave A Comment