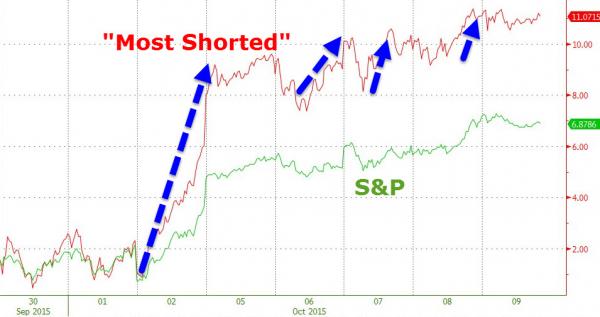

The week summarised… as BofA put it –“It’s Not A Risk-On Rally, This Is The Biggest Short Squeeze In Years”

With China shut and The Fed going full dovish panic-mode over growth fears, world markets went crazy…

LOLume!!

The last 8 days have seen a massive short-squeeze… 2nd biggest in history

The last 2 times stocks were short-squeezed this much, did not end well…

And the following stunning chart shows the percent of S&P 500 names above their 50-day moving-average has soared from 4% to 60% in a few weeks…

h/t @ReformedBroker

* * *

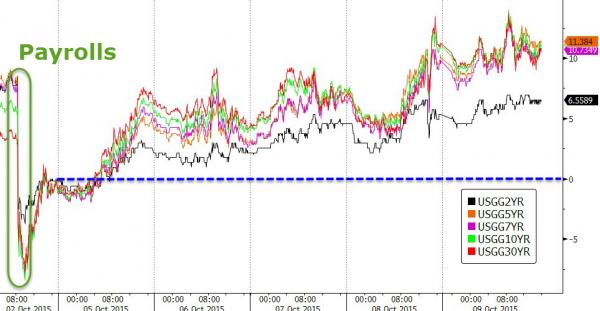

Off the Payrolls lows, it’s been non-stop…

Credit tracked stocks all week but decoupled this afternoon…

VIX has fallen for 9 straight days… the longest streak since Oct 2011..

Energy stocks outperformed and Healthcare (Biotechs) were the laggards…

Treasury yields surged all week but Friday saw the push slow a little… (everything but 2Y is now higher than pre-payrolls)…

The USDollar Index slipped notably after the FOMC Minutes but had been weaker all week… (AUD rose 3.8% on the week)

Leave A Comment