With markets happy to put February in the history books because it marked the fourth consecutive monthly decline in global stocks, we move on to March 1st, which doubles down as ‘Super Tuesday’ in the US when Trump’s presidential candidacy will almost certainly be sealed and a day in which stocks decided to join the super fun by super surging overnight on nothing but bad global macro and economic which however was promptly ignored and instead the focus was on ongoing central bank intervention and even more jawboning.

As Bloomberg puts it “global stocks rallied, emerging-market currencies rose and crude oil climbed after investors across Asia responded favorably to stimulus in China” which is odd because the stimulus was announced over the weekend and stocks tumbled on Monday.

There were three key overnight news events:

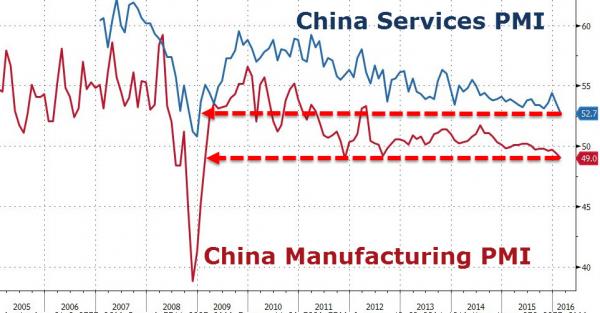

1) the February plunge in China’s PMI, which missed expectations and where the manufacturing index dropped to a 7 year low, while the service tumbled to the lowest level since 2008:

2) the collapse in Glencore’s full year 2015 earnings, which just reported its worst year since going public, as net income plunged 69% to $1.34 billion, and the firm suffered an adjusted loss in its mining division, while announcing plans it will sell another $5 billion in assets.

3) the collapsing earnings and dividend cut by UK’s Barclays, whose pretax earnings plunged 56%, sending the stock tumbling by 10%, the biggest crash since June 2012, on the bank’s deteriorating outlook, the sale of its 62% stake in Barclays Africa, and cutting of the Barclays dividend.

On the surface, one would think that these are not exactly “good” developments and would not lead to a surge in overnight futures, and yet surge is precisely what global markets and US equity futures have done. What sparked the rebound? Well, the Shanghai Composite was largely unchanged for the day when shortly after midnight Eastern, US Treasury Secretary Jack Lew hit the tape when he spoke in briefing in Hong Kong after meeting Chinese officials in Beijing. And this is what unleashed the rally: Lew said that “China assured him it had no need or plans to devalue currency.”

This of course, came one day after China engaged in the biggest currency devaluation in 8 weeks after the conclusion of the G-20 meeting.

The rest of the jawboning from Lew:

Was this the reason for the buying? Of course not, but it provided a handy cover for the BOJ’s latest round of overnight USDJPY intervention which took the paid higher by 100 pips overnight, and since the markets make the news, why not ascribe the “buying catalyst” to Jack.

Elsewhere, European equities headed for a fourth day of gains for the first time since October as investors assessed earnings reports and deal activity. Russia’s ruble and South Africa’s rand led an advance among major currencies and the yuan strengthened for the first time in eight days after the People’s Bank of China cut lenders’ reserve requirements, freeing up funds to help spur lending. Germany’s bonds declined as nickel led gains in industrial metals prices and crude rose in New York. The cost of insuring corporate junk bonds in Europe fell for the fourth day, the longest run this year.

Where markets stand right now

Top Global News:

Looking at regional markets, we start in Asia where stocks initially traded mixed with choppy price action seen overnight as the region digested the surprise PBoC measures coupled with further weak Chinese data. Nikkei 225 (+0.4%) initially underperformed on JPY strength with declines to company profits and capital spending figures adding to the dampened tone. However, the index then recovered alongside a mild reversal in the currency. ASX 200 (+0.9%) was underpinned by commodity sector strength, while the Shanghai Comp (+1.7%) fluctuated between gains and losses as the PBoC 50bps RRR cut was counterbalanced by weak data in which Official and Caixin manufacturing PM’s missed expectations to post a 7th month and 5th month in contraction territory respectively. 10yr JGBs traded flat despite weakness in Japanese equity markets and a weak 10yr JGB auction. As noted previously, Chinese Official Manufacturing PMI (Feb) M/M 49.0 vs. Exp. 49.4 (Prey. 49.4); 7th month of contraction & lowest since 2011.

Leave A Comment