Net worth used to be a simple concept. Add up assets. Subtract liabilities. And celebrate (or mourn) the tangible book value of the company.

It is not so simple anymore.

In a service-oriented economy, the value of a corporation partially depends on several intangibles. How influential is the company’s brand? What about the impact of the personality of one or two key individuals?

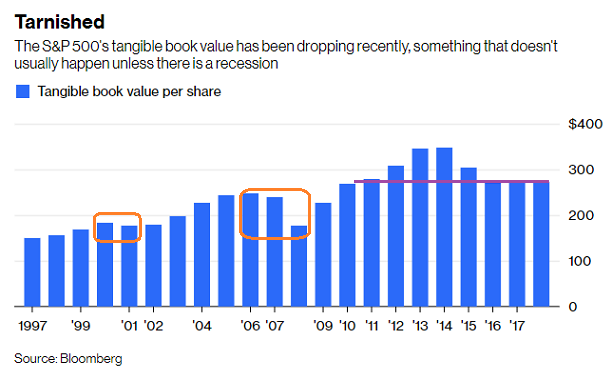

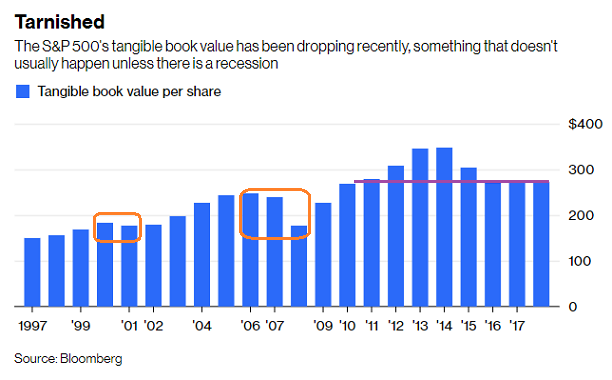

Nevertheless, the increasing importance of intangibles should not diminish the relevance of tangible net worth. Tangible book value for S&P 500 companies has been declining in 2018. In fact, since peaking in 2014, it has reverted back to levels not seen since 2010.

Drops in tangible “book” tend to occur in economic downturns. It happened in the global manufacturing recession (2015-2016). It occurred in the heart of the 2008 Great Recession. Similarly, it transpired alongside 2000’s tech wreck and subsequent 2001 recession.

The trend for book value does not appear particularly friendly. Keep in mind, here in 2018, the S&P 500 trades at an astronomical 10.6x tangible net worth. The 20-year average? 6.4x.

It gets more precarious. According to Bloomberg, 191 S&P 500 corporations have a negative net worth. Think about that. Nearly two-fifths of the largest U.S. companies in existence carry sub-zero tangible book values.

Why is net worth (at least the tangible kind) eroding? For one thing, Companies have spent a lot of balance sheet cash to acquire and retire stock shares. Consequently, the cash component on the asset side of the ledger has decreased.

Perhaps, even more, telling has been the dramatic increase in corporate liabilities. Corporations have nearly doubled their debt obligations since the financial crisis in 2008, from $2.8 trillion to $5.3 trillion. The more debt a company has on its books, the more those liabilities weigh on assets.

It follows that corporate-debt-to-GDP has never been higher. Yet unlike previous peaks in the debt ratio — occasions that corresponded to the inception of equity bear markets — high yield (“junk”) bond default rates have yet to spike upward.

Leave A Comment