For the 25th day in a row (one short of an all-time record), the S&P closed above its 5-day moving-average. Despite dismal Asian, European, and US PMIs, US equity markets sreaked higher at the US Open, tagging yesterday’s highs, then stalling when Europe closed. Small Caps led the day as shorts were squeezed once again but Trannies and Russell 2000 remain negative on the week. US Treasury yields dropped notably after European and ended the day 2-3bps lower (with 30Y unch on the week). The USD rose very modestly close-to-cvlose but traded lower thru the EU and US sessions (AUDJPY was in charge of stocks today). Copper dropped on China growth fears but oil, silver, and gold rose on the day (leaving gold +0.5% on the week). HY credit slammed tighter with stocks early then decoupled after EU closed. Dow & S&P close at record highs.

It’s OPEX tomorrow…

25 in a row.. and counting…

Small Caps led the day…

As shorts got squeezed ouit of the gate

Trannies and Russell remain red on the week despite today’s big surge in small caps…

USDJPY gave up at the US open and AUDJPY took over

Treasury yields and HY credit once again decoupled…

VIX’s opening hour was insanely spotted with fat finger mnanipulations… ramped then rose into the close

Another triple-fat-finger day for VIX…

FX markets saw the USD flat but USDJPY roundtriup back to 118.00

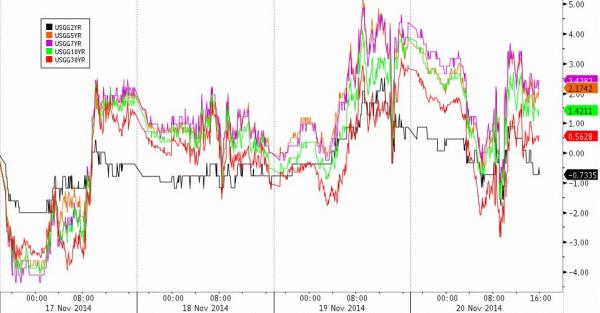

Treasury yields saw volatility today but closed lower with 30Y practically unch on the week

Copper dropped (China weakness) but oil, gold, and silver rose on the day pulling gold green on the week

Gold rallied all the way back up to the pre-Swiss Gold Poll results yesterday…

Charts: Bloomberg

Leave A Comment