The main U.S. stock market indexes gained 0.1-0.3% on Wednesday, as they fluctuated following recent move down. Investors were uncertain ahead of quarterly earnings, FOMC Rate Decision, economic data releases. The S&P 500 index remained below its Tuesday’s relatively big daily gap down. It currently trades around 2.1% below its January 26 record high of 2,872.87. Yet, it remains 4.7% above its December 29 close of 2,673.61. The Dow Jones Industrial Average gained 0.3% on Wednesday, as it bounced off support level at 26,000, and the technology Nasdaq Composite gained 0.1%.

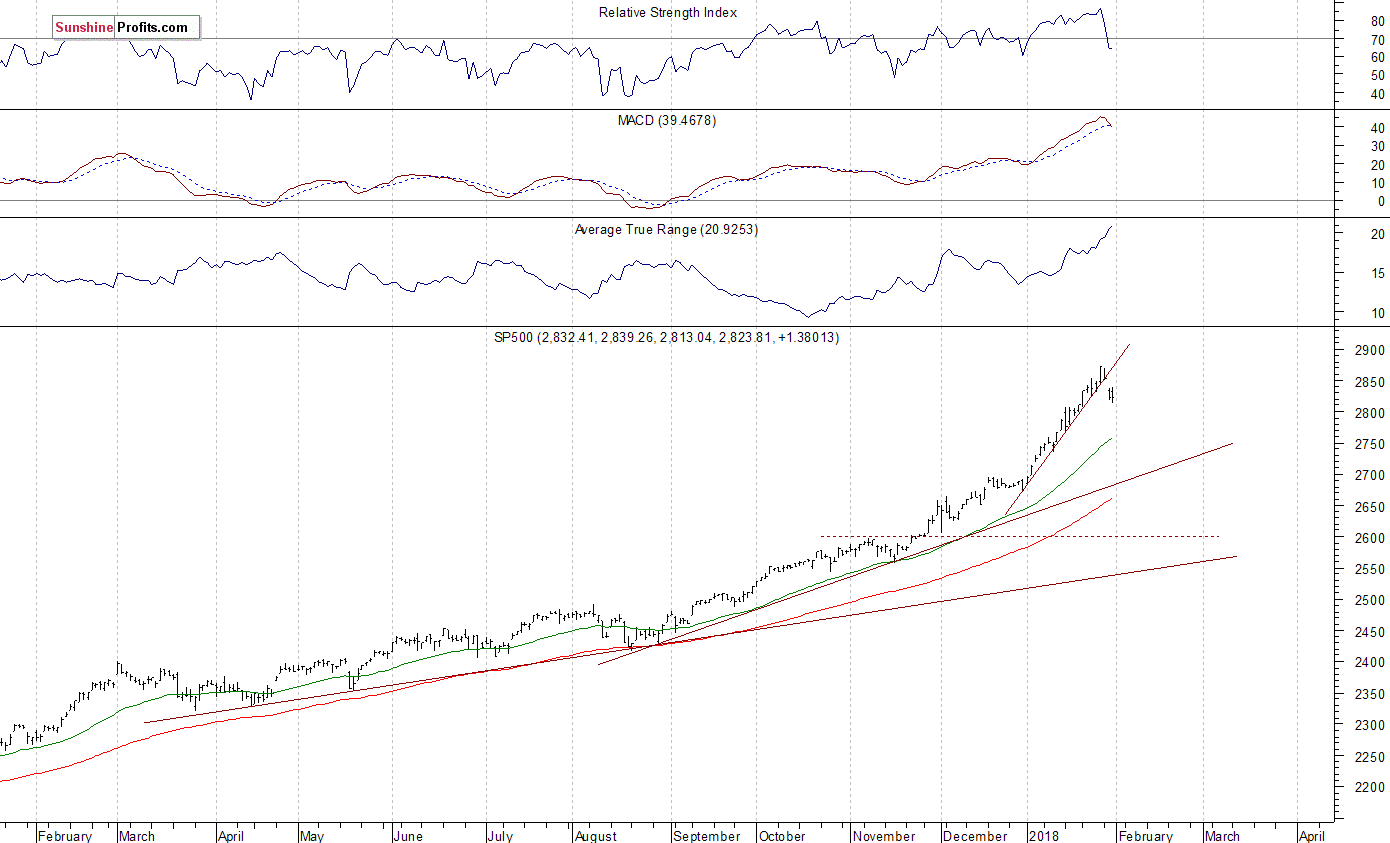

The nearest important level of support of the S&P 500 index is at 2,790-2,810, marked by the January mid-month consolidation. The next level of support remains at 2,770-2,780, marked by some previous local lows. On the other hand, the nearest important level of resistance is at 2,840-2,850, marked by Tuesday’s daily gap down of 2,837.75-2,851.48. The next resistance level remains at around 2,870-2,875, marked by Friday’s record high of 2,872.87. The resistance level is the price level at which the selling interest is strong enough to overcome buying pressure and push the price lower. It usually refers to previous high or highs, gap downs, trend lines, retracement levels etc.

We still can see medium-term technical overbought conditions on the daily chart of the S&P 500 index. There is a pretty big chance that the index reached some major medium-term high on Friday. It broke below its month-long upward trend line on Tuesday following gap-down opening of the trading session, confirming reversal of the uptrend. The market is likely to continue lower, but its short-term downside potential seems limited by a support level of 2,800:

Mixed Expectations, More Consolidation

Expectations before the opening of today’s trading session are mixed, because the main indexes index futures contracts trade between -0.2% and +0.4% vs. their Wednesday’s closing prices. The European stock market indexes have gained 0.1-0.5% so far. Investors will wait for some economic data announcements today: Initial Claims, Nonfarm Productivity at 8:30 a.m., Construction Spending, ISM Manufacturing PMI at 10:00 a.m. The market expects that the ISM Manufacturing number was at 58.7 in January. Investors will also wait for some important quarterly corporate earnings releases.

Leave A Comment