Real Estate Investment Trusts, or REITs, are a popular way for regular investors to participate in commercial real estate.

Generous yields, relatively low volatility, and steady dividend growth can make certain REITs some of the best high dividend stocks for investors seeking retirement income and capital preservation.

This is why larger, famous REITs, such as Realty Income (O), are often core holdings in high-yield income portfolios.

However, the world of REITs is a large one, which is why sometimes it’s worth taking a look at smaller names, such as STORE Capital (STOR).

Let’s take a look at STORE to see why its strong fundamentals have attracted the attention of none other than Warren Buffett, history’s greatest investor, who recently purchased a 10% stake in the company. Investors can review Buffett’s dividend portfolio here.

Specifically, learn if this small but fast-growing REIT may have what a diversified, high-yield portfolio needs, especially at today’s valuations.

Business Overview

STORE Capital (which stands for Single Tenant Operational Real Estate) is a relatively new triple-net lease REIT, having gone public in 2014.

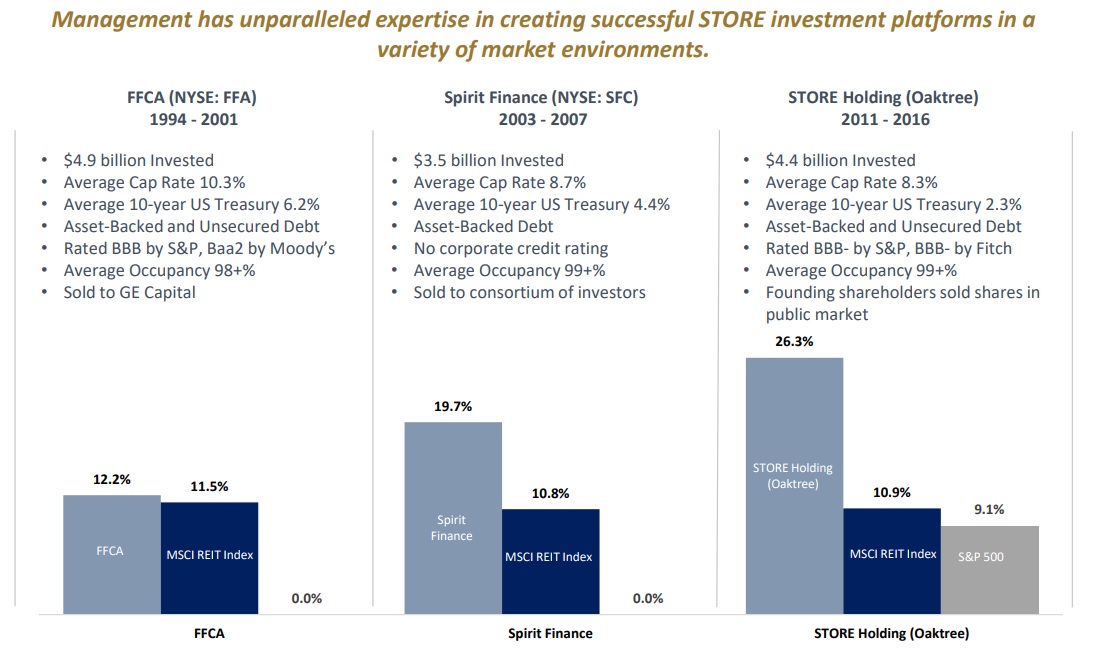

However, it’s led by a management team with 35 years of experience in the industry, having built three previous triple net lease REITs (tenants pay all taxes, maintenance, and insurance costs) with a total of 9,100 properties.

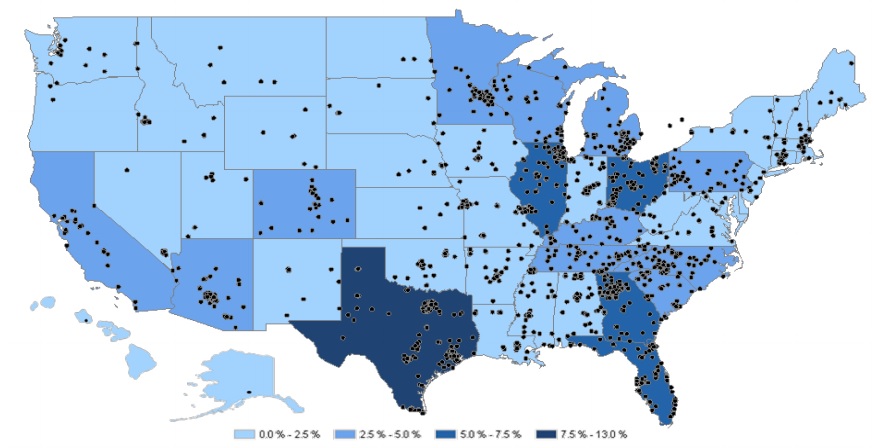

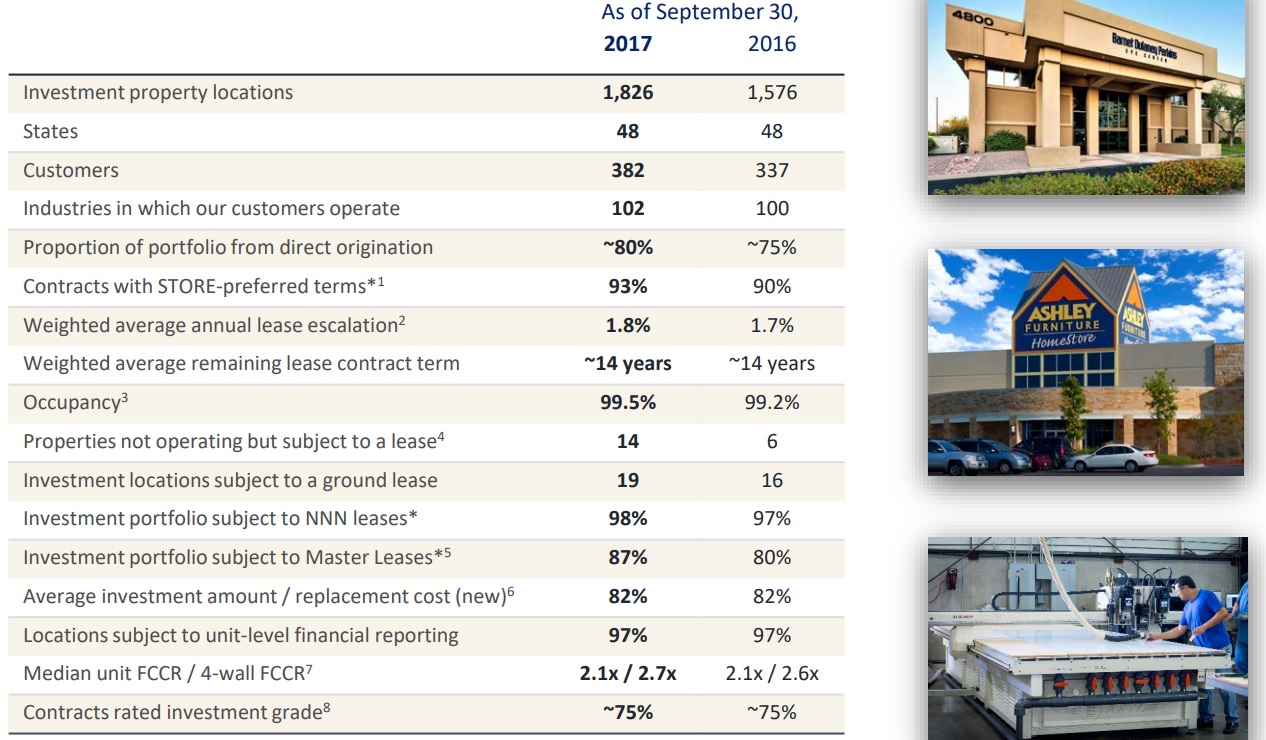

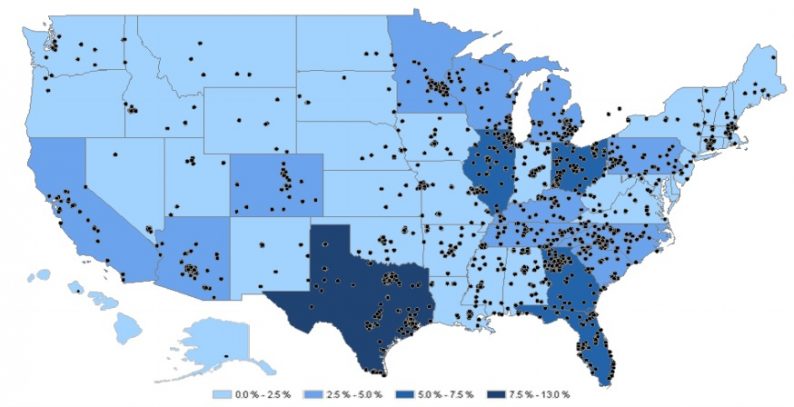

Today, STORE owns 1,826 properties in 48 states leased under long-term contracts (average remaining lease is 14 years) to 382 companies in 102 industries.

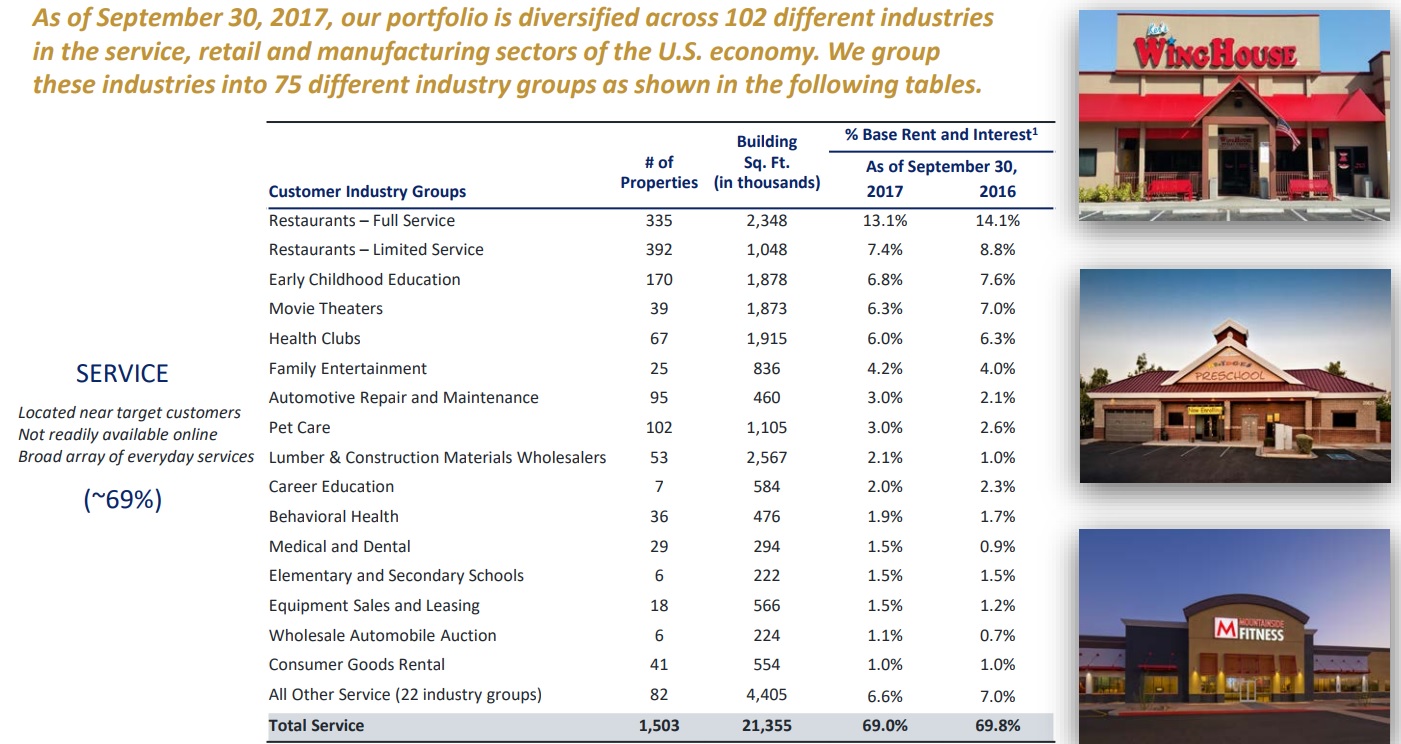

STORE’s rent is derived from:

Source: STORE Investor presentation

Business Analysis

There are three keys to most successful dividend growth stories in real estate: a stream of dependable cash flow, a strong balance sheet, and a long-term focused, conservative management team who knows how to balance growth and dividend safety, as well as adapt to shifting industry conditions.

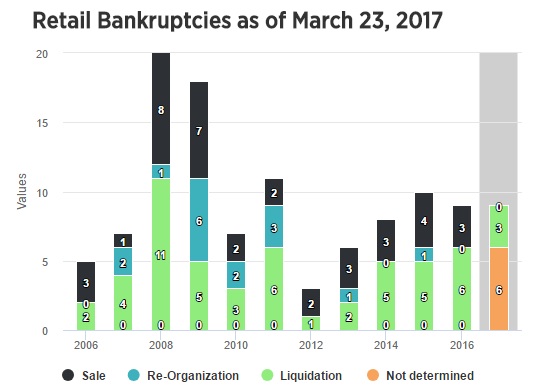

When it comes to triple net lease retail REITs (such as Realty Income and STORE), many investors have become worried over the large number of retail bankruptcies and store closings (the most since the financial crisis), which the media has dubbed “the retail apocalypse”.

Source: Bloomberg

In fact, according to Fung Global Retail, in the first half of the year, 29 retail chains announced they were closing 4,381 stores across the U.S. However, while such headlines might scare Wall Street, quality retail REITs such as STORE actually appear to be well insulated from the carnage.

That’s because they have extremely diversified property portfolios, with very little exposure to distressed retail.

In fact, the vast majority of STORE’s rental revenue is derived from service-oriented businesses, which are largely immune from the disruptive growth of e-commerce.

The remainder of STORE’s properties are similarly Amazon (AMZN) resistant because even the company’s small amount of retail exposure is largely in areas that continue to thrive, such as furniture, farm supplies, and hunting and fishing stores.

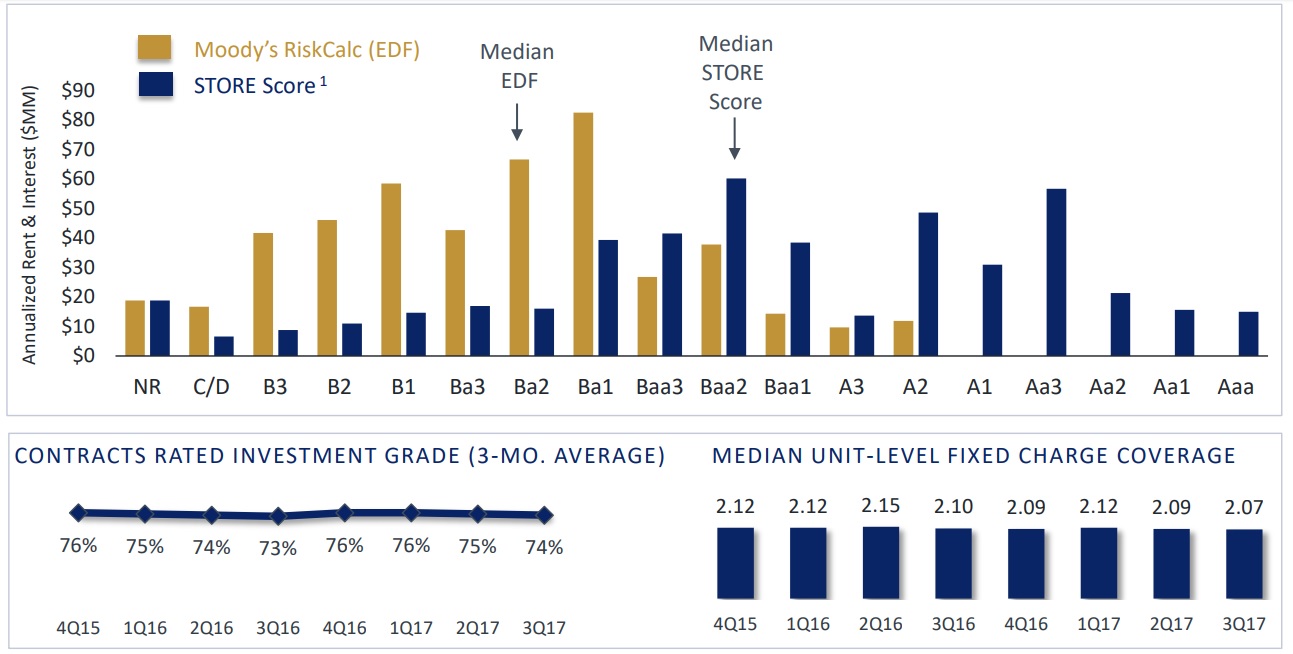

In addition, STORE’s management team, which has decades of experience running triple net lease REIT portfolios, has taken a highly disciplined approach to the types of tenants it targets so that 75% of its tenants are investment grade (only 46% of Realty Income’s (O) tenants can say the same).

Such conservatism reduces the risk of tenants being unable to pay their rent and makes them more capable of accepting rent increases over time.

Additionally, STORE is very careful about making sure that each store’s tenant is financially healthy, targeting conservative unit level fixed charge coverage ratios (tenant cash flow over fixed charges including rent) of 2.0 or greater.

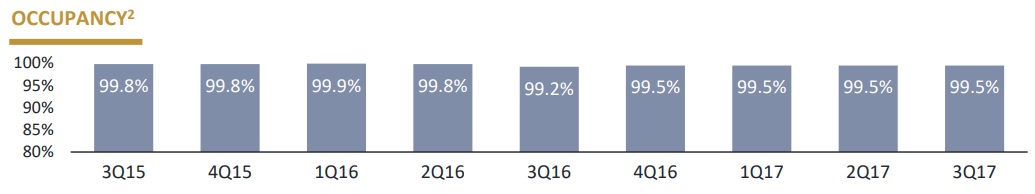

In other words, STORE management is highly disciplined in its growth approach, making sure to only rent to tenants who are unlikely to fail and stop paying rent. This is why its occupancy rates have not only been among the highest in the industry, but highly stable for several years, including during the recent retail industry downturn.

However, what’s even more impressive about STORE is that, despite management’s exceedingly high acquisition standards, the REIT operates in a massive and highly fragmented market, which means plenty of opportunity to grow through acquiring new properties and renting them out to rock-solid tenants over time.

Leave A Comment