After yesterday’s stellar 3Y morning auction, and disappointing 10Y afternoon auction, today’s reopening of the 29-Year, 11-month RZ3 Cusip was right down the middle.

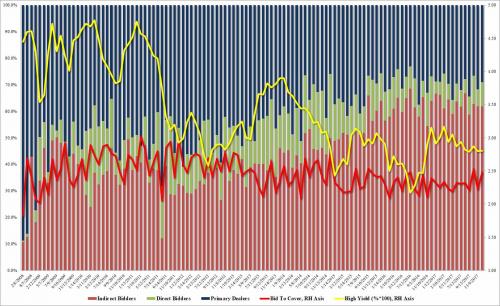

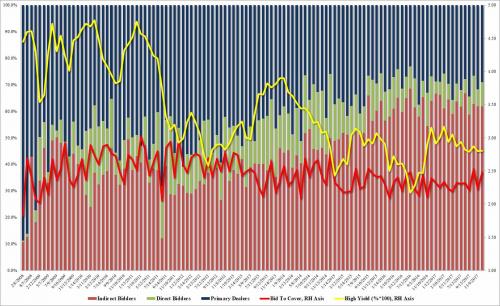

The bond stopped at a high yield of 2.804%, stopping through the When Issued 2.808% by 0.4bps, the third consecutive stop through in a row. The high yield was above November’s 2.801% but below October’s 2.870%.

The internals were solid but not unprecedented: the Bid to Cover rebounded from last month’s 2.225 to 2.479, and above the 6 month average of 2.318. This was the second highest BTC going back to July 2016 with only October’s 2.53% higher.

The Indirect Award was 61.9%, unchanged from last month, and fractionally below the 6 month average 62.6%, while Directs took down 9.0%, above the 6MMA of 7.1%, and Dealers were left with 29.1%, below last month’s 31.8% and below the 6 auction average of 30.3%.

Overall, a solid – if not spectacular – auction heading into tomorrow’s FOMC meeting where Janet Yellen is expected to make her last 25 bps rate hike announcement. That said, the fact that today’s auction wasn’t a disaster, and foreign interest was solid, confirms that the curve will continue to flatten as the Fed rises the short-end every few months, ultimately inverting the yield curve some time in mid-2018.

Leave A Comment