Geopolitical risks and heavy corporate bond issuance likely to keep a lid on U.S. Treasury prices

While August nonfarm payrolls provided further evidence of a strong U.S. labor market, any ensuing optimism about the domestic economy may spur more pain for emerging markets.

Recent gains in the U.S. dollar against currencies such as the Turkish lira, Russian ruble, South African rand and Argentinian peso, have helped make debt financing for most issuers in these countries more challenging, and have generally led fixed income investors to lower their risk tolerance.

Intensifying global trade tensions between the U.S. and its trading partners, as well as geopolitical uncertainties, including Turkey’s ability to contain inflation and stave potential defaults in its financial system, have also been influencing investors’ flight to safe haven assets.

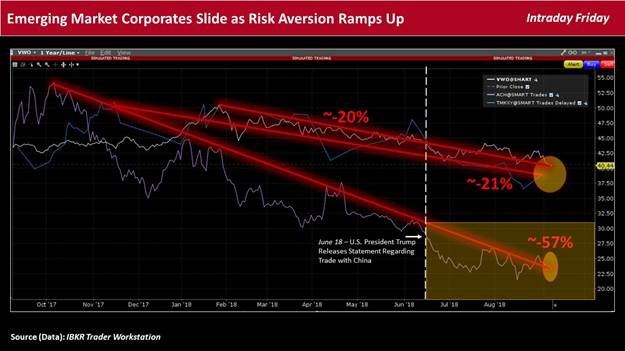

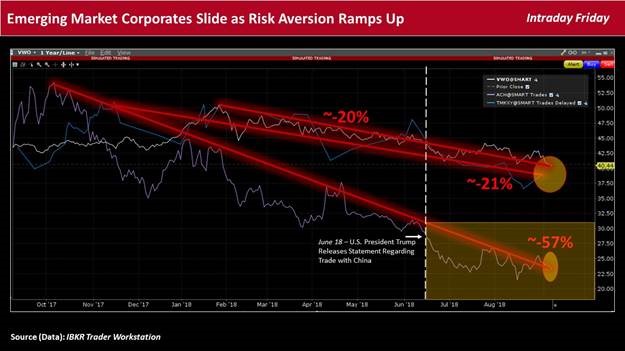

[IBKR Trader Workstation chart tool shows the downward trajectory of the Vanguard FTSE Emerging Markets ETF (VWO), as well as two emerging market ADRs.]

Against this backdrop, the yield on the 10-year U.S. Treasury note rose roughly 8bps intraday Friday to around 2.95% on the back of a better-than-expected employment report from the Bureau of Labor Statistics.

Total August nonfarm payrolls increased by 201k compared to about 190k anticipated, with job gains in professional and business services (53k), health care (33k), wholesale trade (22k), transportation and warehousing (20k), and mining (6k).

Meanwhile, the unemployment rate was unchanged at 3.9%, and average hourly earnings (AHE) for all workers climbed 0.4% for a year-on-year rise of 2.9%.

Likely Fed response

With the market already widely expecting an additional 25bp rate hike by the Federal Reserve’s Open Market Committee (FOMC) at the conclusion to its two-day policy meeting September 26, the latest jobs figures would appear to have cemented the decision.

Jefferies economists Ward McCarthy and Thomas Simons noted that based on the trajectory of the economy and the “likelihood that inflation will be at or ‘close to’ the symmetric 2% dual mandate objective in the months ahead, the Fed is likely to raise rates in September and December for four rates hikes in 2018.”

Leave A Comment