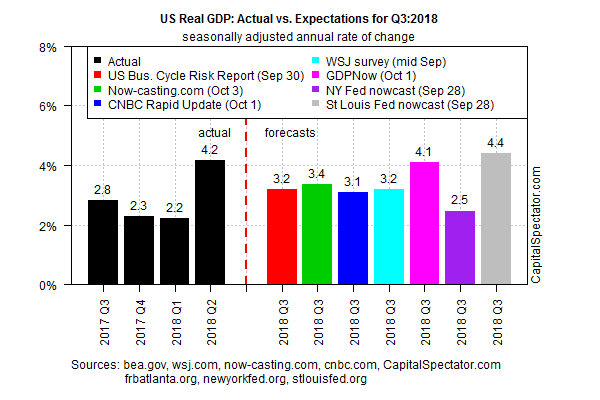

Economic output for the US is on track to post a slower-but-still-healthy gain in the preliminary GDP report for the third quarter that’s scheduled for publication later this month. The outlook is based on a set of nowcasts compiled by The Capital Spectator. The median Q3 estimate: a 3.2% increase, unchanged from the analysis in mid-September.

The current median Q3 projection marks a slowdown vs. the strong 4.2% increase for Q2. Aside from the previous quarter, however, economic growth in the low-3% range still compares favorably with recent history. If the median estimate is accurate for Q3, output is set to post the second-strongest quarterly gain in three years.

Chicago Fed President Charles Evans is on board with the upbeat analysis. “The US economy is doing extremely well,” he told CNBC earlier today. “Fundamentals are strong, the labor market is doing terrific.”

Fed Chairman Jerome Powell offered similar comments on Tuesday. The economy’s performance is “remarkably positive,” he said. “This historically rare pairing of steady, low inflation and very low unemployment is a testament to the fact we remain in extraordinary times.”

The current estimates compiled by The Capital Spectator for the government’s initial Q3 GDP report that’s due on Oct. 26 range from 2.5% to 4.4%. Using the median as a guide suggests that profiles offered this week by Evans and Powell are in line with the latest nowcasts.

It’s debatable if “we have the best economy in our history,” as President Trump opined on Tuesday. But the current data certainly paints an upbeat profile.

The question is whether the deceleration that appears to be underway in the growth trend, albeit relative to the strong recent peak in Q2, will extend beyond Q3? No one knows at this point, but the next major economic release looks bullish via the Labor Department’s nonfarm payrolls data for September, which arrives on Friday (Oct. 5).

Leave A Comment