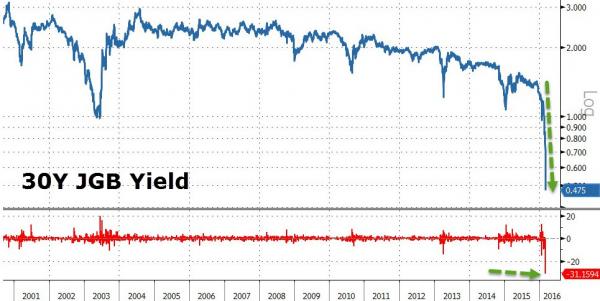

It was just yesterday when we observed the record collapse across the Japanese curve when first the 10Y JGB plunged to an all time low -0.10%, followed promptly by 30Y yields dropping 21bps – the biggest absolute drop in over 3 years and biggest percentage drop ever – to a record low 47bps following Japan’s 30Year auction on Monday night. As we further noted, since Kuroda unleashed NIRP, the entire JGB curve has been crushed and the Monday night rush for long duration debt flattened the curve to record lows.

What a difference a day makes.

Just 24 hours later trading of Japan’s government bond futures was halted for less 30 second after the price of the contracts dropped as much as 0.6 percent. As Bloomberg reports, the dynamic circuit breaker on the Osaka Securities Exchange was activated at 12:32 p.m. and was applied to March contracts according to Masaki Takahashi, who works in the market management department at the Osaka Securities Exchange.

The website of the OSE parent Japan Exchange’s website said the circuit breaker is triggered “to temporarily halt trading in order to allow investors to calm down when the market is overly volatile.”

The reason for the trading halt is that a day after sliding to the lowest yield on record, on Wednesday the benchmark 10-year bond tumbled, pushing yields up eight basis points to minus 0.015 percent as of 2:51 p.m. Yields rebounded after dropping more than five basis points to a record minus 0.1 percent Tuesday. The selloff was triggered after an increase in selling into the BOJ’s POMO when the bid-to-cover ratio for debt with 10 to 20 years to maturity rose to 3.58 from 2.93 last week, indicating stronger investor demand to sell, and that investors were looking to offload inventory to the BOJ.

“Weak outcome of BOJ’s bond purchase, especially 10y-25y tenor, spurs selling JGBs given that yesterday’s rally was excessive move,” says Takenobu Nakashima, quantitative strategist at Nomura Securities.

Leave A Comment