North American silver investment via its domestic supply suffered another large deficit in 2015. How big was the deficit? It was huge, surging 70% compared to 2014… and this only includes silver investment from two Official coin sales.

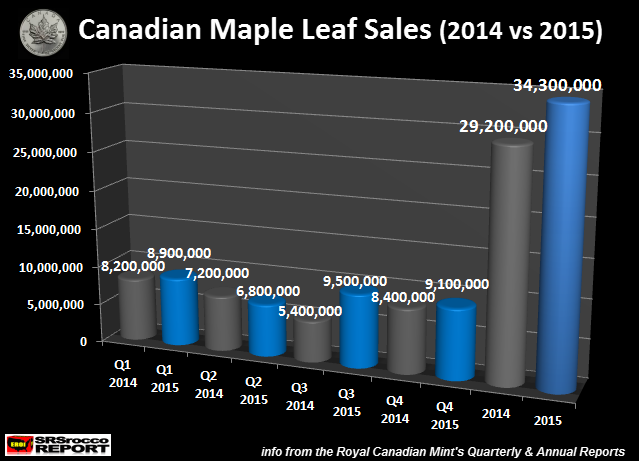

Let me explain. We need to start off by showing the total Canadian Silver Maple Leaf sales for 2015. The Royal Canadian Mint finally published their 2015 Annual Report in which they stated that sales of Silver Maples jumped 18% from 29.2 million (Moz) in 2014 to 34.3 Moz in 2015:

Sales of Canadian Silver Maples started off strong in Q1 2015, but declined in Q2 2015 by falling 400,000 oz compared to the same period in 2014 (7.2 Moz Q2 2014 vs 6.8 Moz Q2 2015). However, things turned around significantly in the Q3 and Q4 2015 during the silver retail investment shortage (July-Oct).

Sales of Silver Maples were a record 18.6 Moz in the second half of 2015 versus 13.8 Moz in the second half of 2014. If we add Canadian Silver Maple Leaf sales to U.S. Mint Silver Eagles for 2015, it jumped to a stunning 81.3 Moz compared to 73.2 Moz in 2014.

I discussed this in my report which was released in June 2015. Here is CHART #37 of a total of 48 charts in the report:

As we can see, combined U.S. and Canadian domestic silver production was 96.6 Moz in 2001 while total Silver Maple & Eagle sales were only 9.2 Moz. Thus, the total Silver Maple & Eagle sales only accounted for 9% of the two countries silver mine supply. This trend started to change significantly in 2008 as Silver Maple & Eagle sales consumed nearly half of U.S. and Canadian silver mine supply.

However, this trend turned into a deficit 2011 as Silver Maple & Eagle sales were 9.4 Moz higher than domestic silver mine supply (63.1 Moz Official Coins vs 53.7 Moz supply). Even though Silver Maple & Eagle sales declined in 2012, the net investment supply deficit resumed again in 2013 and 2014. Matter-a-fact, Silver Maple & Eagle sales were nearly 20 Moz more than U.S. and Canadian domestic silver mine supply in 2014.

Leave A Comment