My Swing Trading Approach

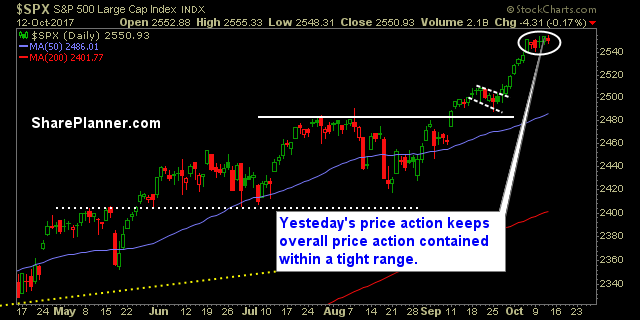

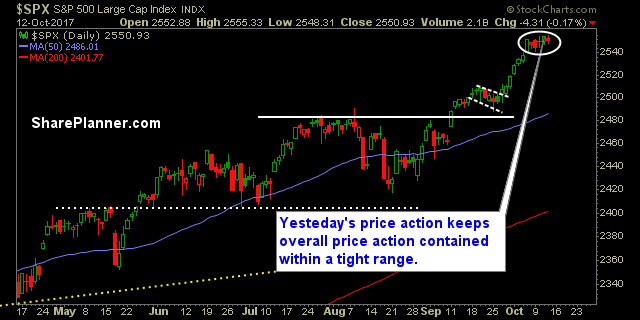

I’m nearing a point where I want to see price action move out of the recent price coil before getting any more aggressive on this market. As always, I’ll look for opportunities where appropriate, to book profits and move up stop-losses.

Indicators

VIX – Slight uptick, still below 10 at 9.91. But not much else worth noting.

T2108 (% of stocks trading below their 40-day moving average): Still hovering at 73%. Still no change over the last two days.

Moving averages (SPX): Broke below the 5-day moving average intraday, for a fourth straight day, and for a fourth straight day, managed to close above the 5-day moving average.

Industries to Watch Today

Consumer Defensive and Utilities still leading the way. Some concern there, as the pattern continues to persist. Industrials rebounded and broke out of recent consolidation. Energy, Financials, and Consumer Cyclical, were all very weak.

My Market Sentiment

I’m waiting to see what short-term direction the market wants to take here. The best way to determine what will be the recent six day consolidation pattern and which side of it, the market breaks on.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment