My Swing Trading Approach

I have a balanced portfolio at this moment and need to see whether the bulls can bounce this market or not, before adding additional long positions to the portfolio.

Indicators

VIX – Broke a 6 day winning streak, finishing 3% lower to 11.33, despite the market being bearish overall.

T2108 (% of stocks trading below their 40-day moving average): Significant amount of selling wiping out the previous four days of gains, dropping 7% down to 56%.

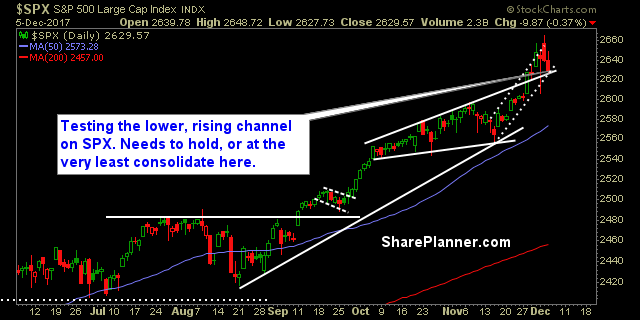

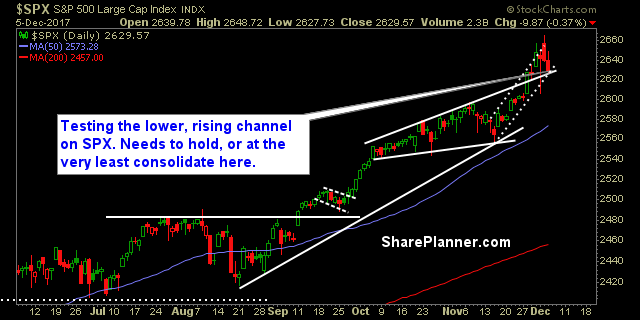

Moving averages (SPX): 5-day moving average broken yesterday, now looking to test the 10-day moving average at the market open today.

Industries to Watch Today

Technology was the only industry that was up yesterday, and it was barely up too. There should be some opportunities for a bounce in the coming days with tech. Consumer Defensive chart still very strong. Healthcare continues to take a significant beating over the last two days and may be trying to roll over here. Financials still look solid. Utilities took the biggest hit, with Basic Materials falling in just behind.

My Market Sentiment

It would seem to me, that following a three-day pullback in SPX, which hasn’t been seen since August 10th, that the market may garner some buying interest here, and pop the indices yet again. Yesterday, looked to do that but spent the entire afternoon giving up all of its gains. Right now, I think the market still leans bullish, as there has yet to be any real panic or fear that has entered into the market.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment