My Swing Trading Approach

Last few days the market breadth has been extremely poor. That has me concerned and will likely limit how much more long exposure I add to the portfolio today.

Indicators

VIX – Moved higher for the second straight day. The bears tried to pounce on it but no luck.

T2108 (% of stocks trading below their 40-day moving average): Coming in at 63%, stocks have lost their mojo for 6 of the last 7 trading sessions.

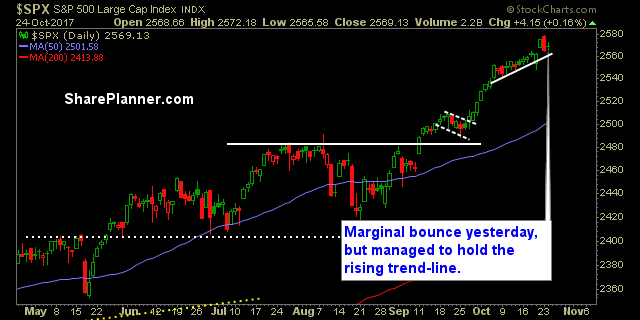

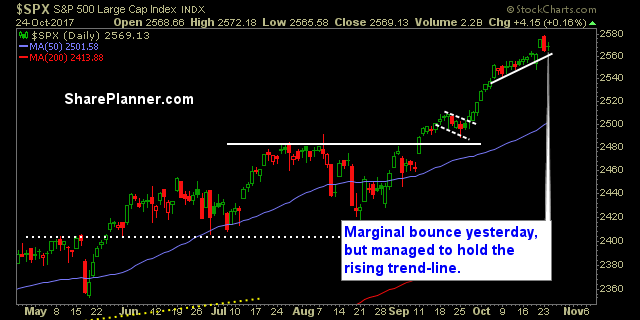

Moving averages (SPX): SPX closed on the 5-day moving average. Any weakness will break this MA, and possibly the 10-day MA.

Industries to Watch Today

Healthcare trying to put in a double top, Defensive and Real Estate showing some weakness of late. Basic Materials have been choppy, but still pushing higher. Financials and Industrials are as strong as can be.

My Market Sentiment

Gaps higher don’t stick. It would be interesting to see if the same is true for gap downs. Volatility is amiss.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment