Recent Tariff-Related Industry Performance

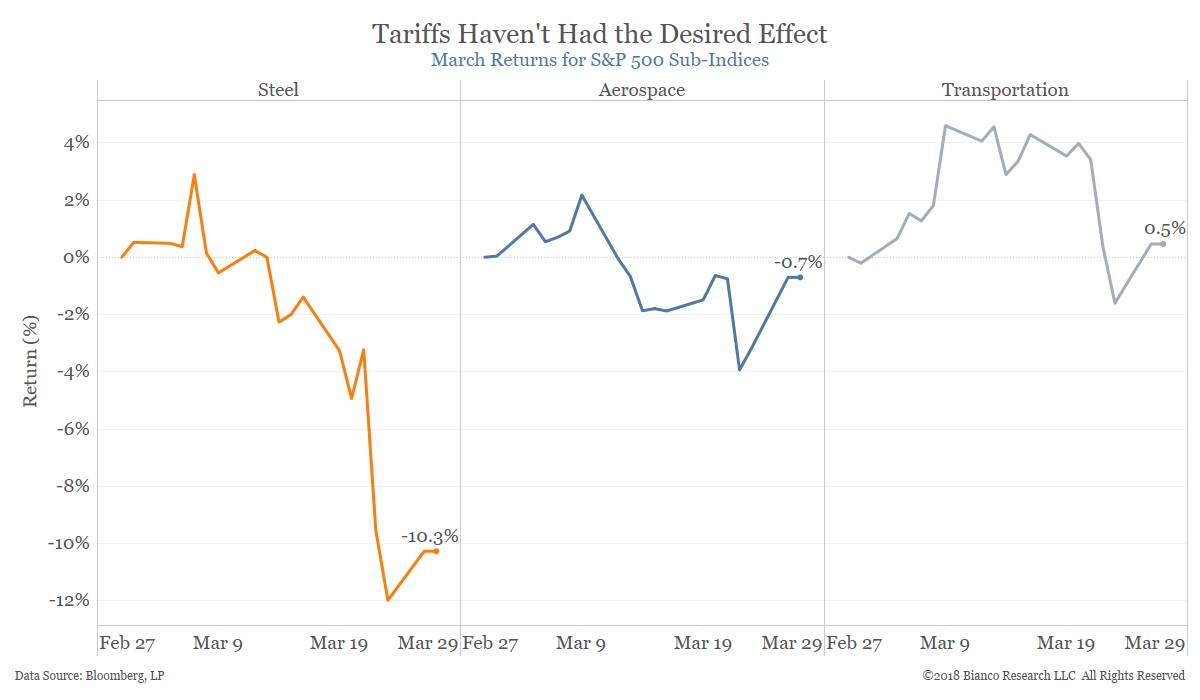

The 3 charts below show three industries which are supposed to be the most affected by the tariffs. The steel industry is supposed to be helped, but it has been down over 10% in the recent weeks. Investors aren’t hopeful that the tariffs will stick without a retaliation. While the overall market rebounded on Monday because investors realized that the small tariffs won’t crash the economy, investors are also expecting little positive impact. The whole prospected of a trade war has turned into a ‘nothingburger.’ The media narrative has run its course as national attention was gained even though major action hasn’t taken place yet. A threat of greater action isn’t a big deal unless it is acted upon.

The aerospace industry hasn’t been hurt by the tariffs even though it is exposed to them. The aerospace and defense industry will be helped by the increase in defense spending in the latest budget which is a much bigger deal than the tariffs. The transportation industry, which is also expected to be hurt by the tariffs, has had flat performance. It is also expected to be modestly helped by the recent budget as $10 billion was appropriated for infrastructure spending. I wouldn’t be surprised if another infrastructure bill is debated this year which promises to spend even more money on infrastructure.

Not Your Average Correction

The narrative in the financial press has shifted from expecting a melt up where stocks never fall, to one where pundits are saying this year will be a return to normalcy where stocks correct sometimes. I actually agree with the narrative. My advantage is I made this point before the correction rather than after it. Because corrections are fairly normal, the current one is being compared to others. As you can see from the chart below, the recent re-test of the lows makes this one lag the average of the past 6. I don’t think it’s fair to expect this one to come close to following the recent average because the decline is coming from a point where retail investors were the most optimistic in history. The market needs to bring more psychological pain before the euphoria is wiped out. Plus, the recent economic data doesn’t justify higher prices.

Leave A Comment