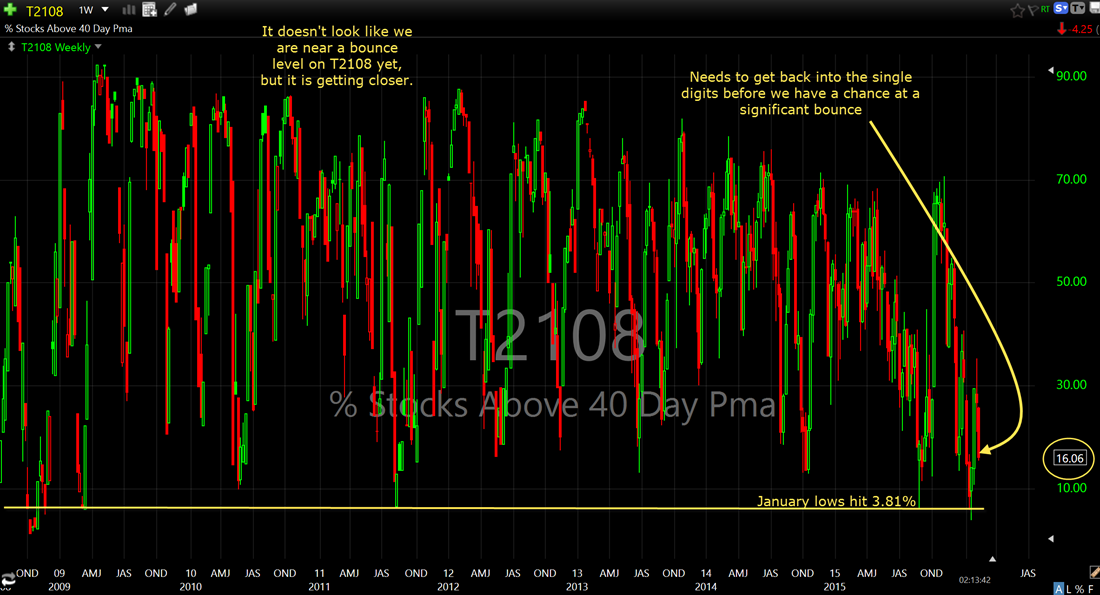

Alright – it is time to post another update on the T2108 – what is it you ask? (in the case you haven’t been following this blog for very long). It is the percentage of stocks trading above their 40-day moving average.

This is probably the single best predictor I know when it comes to finding market bounces. And by the looks of it, the bounce isn’t happening just yet if history is any indication. It used to be that a move into the teens was a great opportunity to get long on the market for an anticipated market bounce right around the corner. But lately that has not been the case, instead driving the T2108 into insanely bearish territory, namely the single digits before getting a bounce.

That is what happened in January when SPX bottomed out at the 1812 level – the reading was 3.81% – that is insane!

Right now it is hovering in the 16’s and unless it is a massive bullish divergence (and that is always a possibility too), then I think SPX has further to go to the downside, and that means breaking those January lows and going sub-1800.

As for now, I won’t consider getting heavily long until the single digits are revisited again.

Leave A Comment