(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 85.9%

T2107 Status: 35.7%

VIX Status: 17.4

General (Short-term) Trading Call: cautiously bullish

Active T2108 periods: Day #17 over 20%, Day #16 over 30%, Day #13 over 40%, Day #10 over 50%, Day #6 over 60%, Day #5 over 70%, Day #3 over 80% (overbought)

Commentary

Could be a big day for $CAT. Trading above 200DMA. Hasn’t done that since around Nov, 2014.

— Dr. Duru (@DrDuru) March 7, 2016

In the flip side, $GOOG looks like it is confirming 50DMA resistance. On watch.

— Dr. Duru (@DrDuru) March 7, 2016

Ditto $AMZN. Stock has tried now 4 days straight to break 50DMA resistance…to no avail.

— Dr. Duru (@DrDuru) March 7, 2016

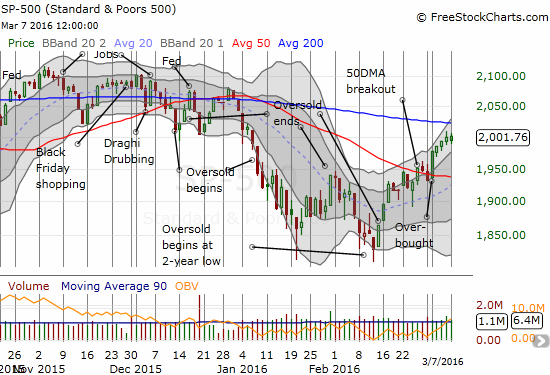

Many of the speculative run-ups I described in the last T2108 Update continued to start trading this week. T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs) managed to eek out yet another daily gain to close at 85.9%. T2107, the percentage of stocks trading above their respective 200DMAs, further supported the on-going bullish mood with its fifth straight gain to close at 35.7%. T2107 has declined only TWO days since the February 11th bottom at oversold trading conditions; T2108 has experience three down days over this span. The S&P 500 (SPY) once again obscured the underlying bullishness, this time with an imperceptible 0.09% gain.

The S&P 500 practically stood in place on the day despite underlying bullishness across the market.

Leave A Comment