T2108 Status: 47.9%

T2107 Status: 21.8%

VIX Status: 20.7

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #7 over 20%, Day #6 over 30%, Day #3 over 40% (overperiod), Day #55 below 50%, Day #70 under 60%, Day #411 under 70%

Commentary

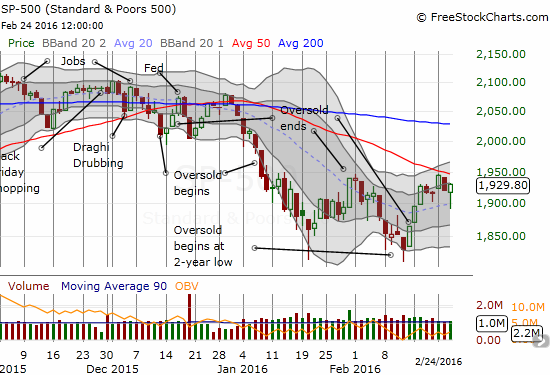

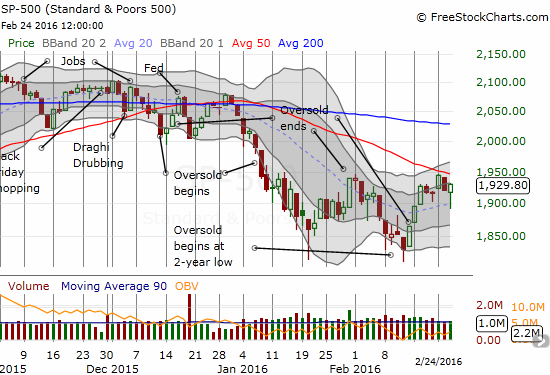

T2108 closed exactly where I left it two days ago: 47.9%. The S&P 500 (SPY) closed lower than where I left it two days ago: 1945.50 versus 1929.80. This is technically a small bullish divergence. The on-going bounce from oversold conditions continues to experience broad participation even if the leaders that drive the S&P 500 are not always cooperating.

Buyers bounced the S&P 500 off a now rising 20DMA (which also happened to coincide with 1900). Overhead resistance from the 50DMA is looking slightly less ominous now.

The close-up chart above shows how the S&P 500 (SPY) has so far failed to conquer overhead resistance at a declining 50-day moving average (DMA). The selling on the day was deep enough at the lows to make resistance look confirmed. However, the selling lasted just over 30 minutes. Buyers stepped in around rising 20DMA support which also happened to coincide with the round number 1900. Buyers never looked back as they closed the index at its highs on the day. This was a very important and critical reversal and statement by buyers. It turned the odds further in their favor. The overhead resistance from the 50DMA looks a little less ominous now.

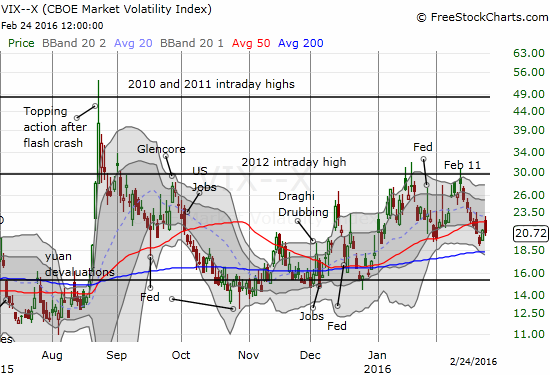

The volatility index, the VIX, worked in reverse. For a breif moment, the VIX traded above 50DMA resistance, but it could not hold that level. Now, the 50DMA looks like stiffer resistance.

The volatility index, the VIX, continues to break down.

Once again, market observers looked to oil to explain the day’s moves in stocks. On a closing basis, oil did seem to drive the action. An intraday view shows a much more nuanced picture. Oil inventories were reported at 10:30am Eastern. Oil spiked higher and then quickly reversed those initial gains. The S&P 500 remained mostly flat through that entire move. As oil took off for good, the S&P 500 also made a more definitive move off its intraday low. From there, the index mainly moved higher into the close whereas oil was much more choppy. There was even a stretch from 1 to 2pm where oil glided downward while the S&P 500 continued higher. In other words, contrary to assumptions, traders cannot automatically look to oil as a guide for trading stocks – at least not based on today’s action. I use United States Oil (USO) as a proxy for intraday oil prices.

Leave A Comment