T2108 Status: 25.2% (as low as 22.9%)

T2107 Status: 52.3%

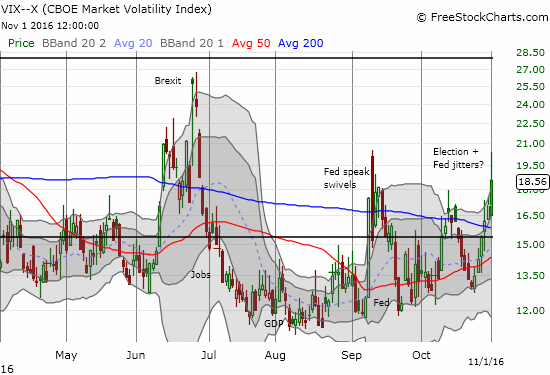

VIX Status: 18.6 (an 8.8% gain, the VIX was as high as 20.4)

General (Short-term) Trading Call: neutral (see caveats below)

Active T2108 periods: Day #177 over 20%, Day #3 under 30% (underperiod), Day #8 under 40%, Day #25 under 50%, Day #40 under 60%, Day #66 under 70%

Commentary

In my last T2108 Update, I described Friday’s rush to sell stocks in the wake of political headlines as overdone and an opportunity to fade volatility. I made this claim even while acknowledging that growing divergences in the stock market significantly raised the odds of an imminent tumble toward or into oversold territory for the stock market. I was also a little hesitant to execute the fade because the volatility index, the VIX, had just popped over the 15.35 pivot and positioned itself to launch even higher. Sure enough, the VIX has gained two more days for a total of 6 straight days. The VIX is up 42.5% since the Monday of last week. At today’s intraday high, the VIX had gained 56.9%.

The volatility index, the VIX, soared past the critical 20 level before fading hard.

As a reminder, a VIX of 20 is conventionally considered “high.” September’s burst of volatility could only produce an above 20 reading for part of the day. Brexit trading swivled around 20 before completely imploding. With T2108 – the percentage of stocks trading above their respective 40-day moving averages (DMAs) – tumbling toward oversold levels, I went back to work fading volatility.

%stocks > 40DMA ~ 26%. Approaching oversold (20%). Close here would be lowest since Feb. Post-Brexit intraday low was 24.5%. #T2108 $SPY

— Dr. Duru (@DrDuru) November 1, 2016

%stocks > 40DMA got as low as 23%. Level not seen since Feb sell-off. #VIX spike may make this “close enuff” to oversold (20%) #T2108 $SPY

— Dr. Duru (@DrDuru) November 1, 2016

T2108 dropped closer to oversold territory (below 20%) than it did in post-Brexit trading.

Leave A Comment