T2108 Status: 43.5%

T2107 Status: 27.7%

VIX Status: 18.4

General (Short-term) Trading Call: bearish

Active T2108 periods: Day #29 over 20%, Day #28 over 30%, Day #28 over 40% (overperiod), Day #1 below 50% (underperiod), Day #3 under 60%, Day #343 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

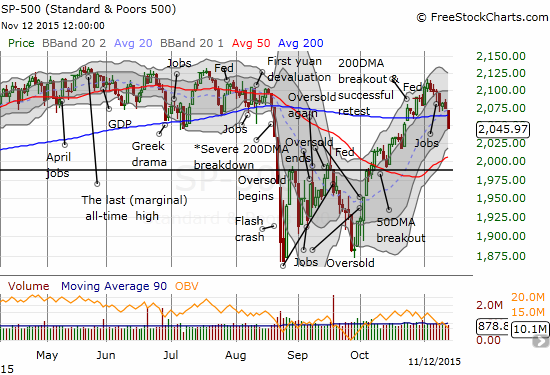

I have been writing this week about the deteriorating underlying technicals of the stock market. Today’s 1.4% drop in the S&P 500 (SPY) caused a breakdown of 200-day moving average (DMA) support and confirmed all the red flags. Accordingly, I have changed the short-term trading call from “slightly bearish” to bearish.

200DMA support gives way for the S&P 500

Note that I am still not aggressively bearish because the 50DMA is now turning upward and SHOULD provide strong support absent a definitive negative catalyst. The next assessment will likely depend on how well the S&P 500 trades around its 50DMA.

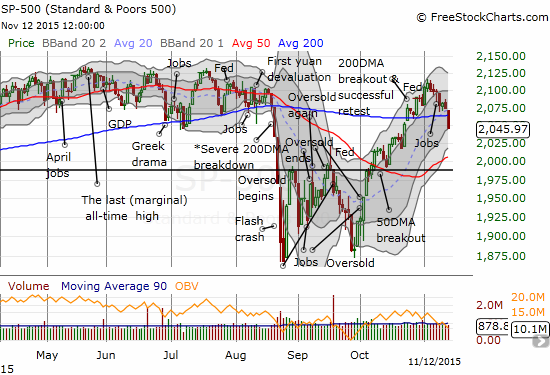

Accompanying the breakdown was a plunge in T2108. The percentage of stocks trading above their respective 40DMAs plunged from 52.6% to 43.5%. This drop completes and confirms the end of a month long range for T2108.

T2108 breaks down after a month-long tease churning just below the overbought threshold

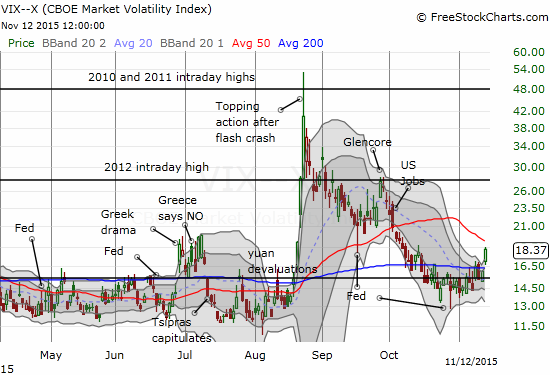

The volatility index, the VIX, joined the bumrush by breaking out to a 5-week high. I did NOT use this occasion to fade volatility as I often do. Besides, there is no imminent meeting of the Federal Reserve to help grease the skids for volatility. That will be a trade for mid-December.

The volatility index, the VIX, is breaking out above the 15.35 pivot and looks ready for another quick run-up

Leave A Comment