(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 36.5%

T2107 Status: 30.0%

VIX Status: 18.1

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #43 over 20%, Day #42 over 30%, Day #1 under 40% (ending 12 dys over 40%) (underperiod), Day #2 below 50%, Day #17 under 60%, Day #357 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

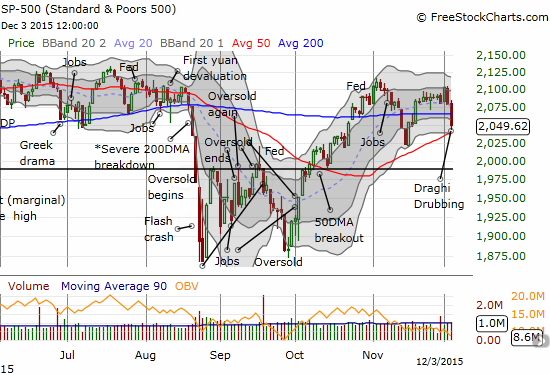

In the last T2108 Update I warned that the S&P 500 (SPY) experienced a notable setback. The action on December 3, 2015, delivered definitive follow-through selling.

The S&P 500 (SPY) plunges through its 200DMA again on its way to a retest of 50DMA support.

Note that my trading call was not predicting the market’s reaction to the news of the day: the latest monetary policy decision from the European Central Bank (ECB). What I will call the Draghi Drubbing (the president of the ECB is Mario Draghi) simply provided a sufficient catalyst to trigger the follow-through selling. Think of the market being primed to throw a tantrum at even the slightest disappointment. The divergence I noted exposed the market’s true underlying weakness.

Leave A Comment