I am keeping this update short given the tragic terrorist attack in Paris Friday night, November 13th. It is very possible that the nature and tenor of trading change as a result. I visited Paris for the first time last year. Although it was a quick day trip in the middle of a layover, I thoroughly enjoyed myself and still look forward to visiting again one day soon. My prayers go out to everyone impacted by this atrocity.

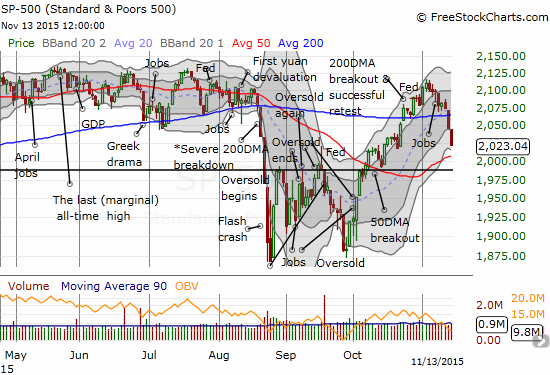

The S&P 500 (SPY) lost 1.1% on the day, and finished the week with a 3.6% loss. It was a week the began ominously; the selling validated the alarm bells I rang to start the week.

An important test of support at the 50-day moving average (DMA) looms for the S&P 500.

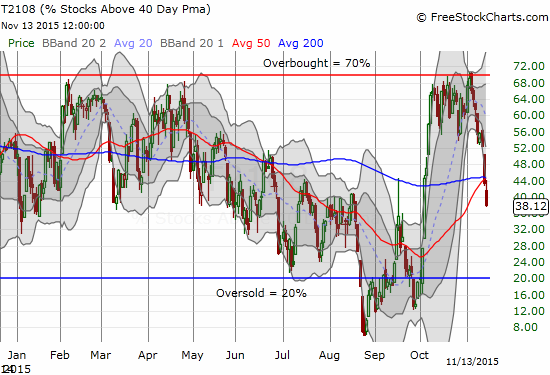

The 50-day moving average (DMA) is trending upward, so a test of this support is very critical for the S&P 500. The potential test comes with T2108 plunging from 61.7% to start the week to 38.1% to close the week.

T2108 plunges out of the trading range that defined its behavior for a month just below overbought status.

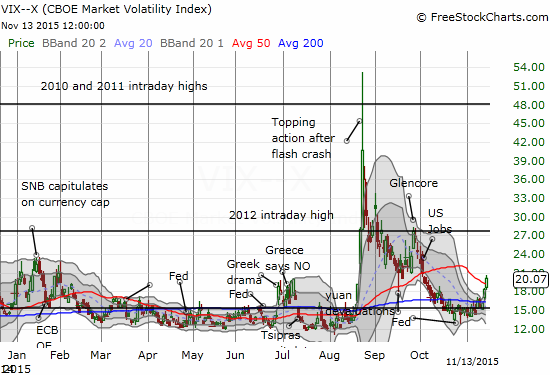

Once T2108 drops into the 30s, I start to think about oversold trading conditions. In recent years, the low 30s have served as “close enough” to trigger a (short-term) bottom in the trading action. In this case, I am more interested in fading volatility than playing the S&P 500. I strongly suspect that any bounce in the S&P 500 will be short-lived and capped by its 200DMA. The volatility index, the VIX, is reaching “elevated” status at 20.1. I would target a return to the 15.35 pivot on a fade and make the trade a quick flip on shares of ProShares Short VIX Short-Term Futures (SVXY).

The volatility index is making a move

For trading, I unloaded a lot of put options Thursday and Friday. These were positions primarily on stocks I featured in various charts during the week. I was glad to have them convert so quickly. I dabbled i some call options on select positions.

One small sign that things could soon turn for the buyers and bulls is Caterpillar (CAT). It made a very bearish breakdown with a gap down below its 50DMA on Thursday, but on Friday the stock showed very surprising relative strength. CAT managed to rally while most of the market was selling off.

Leave A Comment