Tackling Inflation Worries in the UK: Gold Investment Strategies for a Prosperous 2024

Worried about inflation in the UK? You’re not alone. As inflation continues to climb in the UK, many investors are looking for alternative approaches to protect their assets. One such approach gaining traction is gold investment. In a time of economic uncertainty and rising inflation, gold has often been considered a safe haven for preserving wealth.

So, what’s behind this renewed interest in gold? Recent research from the Royal Mint indicates that investors are increasingly turning to gold and other alternative investments to hedge against high inflation and market volatility. This year, gold has seen a significant uptick in its price, making it increasingly attractive as an investment option for those concerned about inflation.

As we head into 2024, it’s important to consider the potential benefits of a gold investment. Historically, gold has had a strong relationship with inflation, often acting as a hedge when inflation significantly exceeds policymakers’ targets. By including gold in your investment portfolio, you can potentially safeguard your wealth against the erosion of purchasing power and enjoy a sense of financial security during these turbulent times.

Understanding Inflation in the UK

As we dive into the topic of inflation in the UK, it’s important to first get a grasp on the historical context, and the current CPI (Consumer Price Index) and ONS (Office for National Statistics) statistics. So, let’s start by examining the past and present inflation-related data to see where we stand.

Historical Context

Inflation is no stranger to the UK’s economy. Over the years, inflation has ebbed and flowed, sometimes more dramatically than others. For instance, inflation in the 1970s and 1980s saw some of the highest in history, with rates soaring up to 30-year highs. Fast forward to the 21st century, the UK has experienced periods of relatively low inflation, in part due to globalisation and technological advancements.

Remember the financial crisis in 2008? That event pushed the inflation rate down, but the cost of living eventually bounced back. Key factors driving inflation in recent years have included Brexit uncertainties, resulting in supply chain disruptions and changes in import prices.

Current CPI and ONS Statistics

Now, let’s dig into some of the most recent numbers. As of October 2023, the CPI stood at 4.2%, marking the fastest rate increase in almost a decade, primarily driven by higher fuel prices. While the current increase still seems worrying, it’s worth noticing that this is lower compared to earlier this year when rates exceeded 10%.

The ONS routinely releases inflation data, and according to recent numbers, price rises are slowing across many products and services. The Bank of England predicts that inflation will continue its decelerating trend and return to more normal levels by the end of 2025. So what does this mean for you?

As an investor, being aware of the inflation landscape in the UK is crucial to ensure your investment decisions align with these developments. Given the current inflationary environment, a gold investment approach might be an interesting strategy for 2024 to hedge against possible risks and optimise returns.

The Role of Gold as an Inflation Hedge

As an investor, you might be concerned about inflation and its effects on your portfolio. If that’s the case, it’s essential to understand the role gold can play as an inflation hedge. In this section, we’ll examine gold’s historical performance during inflationary periods and how it compares with other asset classes.

Gold’s Historical Performance

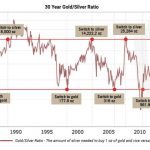

Traditionally, gold has been viewed as a safe haven asset in times of economic turmoil. This is because its price often maintains its value or even appreciates when inflation erodes the purchasing power of fiat currencies. For instance, during the first half of 2022, demand for gold increased as prices rose across the economy.

However, gold’s track record as an inflation hedge has been mixed. Some historical periods show it performing well, while others suggest it might not be the ultimate answer to inflationary concerns. So, is gold an investment approach worth considering to combat inflation in the UK for 2024? Let’s explore further by comparing it to other asset classes.

Comparative Analysis with Other Asset Classes

To help you make an informed decision, let’s compare gold’s performance to other asset classes, such as bonds and equities. As a rule of thumb, the best-performing asset class during a particular period depends on various factors, including inflation rates, interest rates, and underlying market conditions.

Gold: As a precious metal, gold can offer diversification to your portfolio and potentially act as a hedge against currency debasement and excessive asset price inflation3. However, remember that gold prices can be volatile and may underperform during certain economic conditions.

Bonds: Bonds are typically less volatile than equities and can provide a regular income stream. Real yield, which takes into account inflation, is often a crucial factor to consider when investing in bonds. If inflation rises, it may have an adverse effect on the real yield. This is important for you to weigh up when building your portfolio.

Equities: Equities offer the potential for capital gains and may outperform other asset classes during periods of strong economic growth. However, bear in mind that equities can also be volatile and potentially affected by inflation.

Here’s a summary of each asset class:

- Forbes Advisor, Is Gold An Inflation Hedge? ?

- CNBC, Gold as an inflation hedge? History suggests otherwise

- World Gold Council, Gold as a strategic inflation hedge

Strategies for Gold Investment in 2024

In 2024, as you tackle inflation worries and look for long-term investment opportunities, considering gold as part of your investment portfolio can be a wise decision. Let’s explore a few strategies to help you make informed decisions about gold investment.

Diversification in Portfolios

One essential aspect of investing is diversification. To reduce the risk and volatility of your investment portfolio, it’s crucial to diversify across various asset classes. Adding gold to your existing mix of equities, fixed income, and cash can be beneficial for the following reasons:

- Gold has historically shown a low correlation with other financial assets like stocks and bonds, providing an effective hedge against market volatility.

- The World Gold Council reports a strong performance of gold in 2023, potentially carrying that momentum into 2024.

- Gold can be a safe-haven asset during times of economic and geopolitical uncertainty.

To ensure a balanced approach, allocate a suitable portion of your long-term investment portfolio to gold, in line with your risk tolerance and financial goals.

Investment Vehicles: ETFs and Share Dealing

When it comes to investing in gold, you have several options. Two popular and convenient methods are Exchange-Traded Funds (ETFs) and share dealing in gold-mining companies:

ETFs: Gold ETFs are a straightforward way to gain exposure to the gold market. They typically track the performance of gold prices, and each share represents a fraction of an underlying gold asset. A few key advantages of investing in gold ETFs include:

-

- Liquidity: Gold ETFs can be quickly bought and sold on exchanges like shares.

- Cost-effectiveness: Since they don’t involve physical storage or insurance costs, ETFs can be a more affordable choice.

- Transparency: ETFs provide real-time gold prices, making it easy for you to monitor your investment.

Some popular gold ETFs in the UK include the Invesco Physical Gold ETC (SGLD) and the iShares Physical Gold ETC (SGLN).

Share Dealing: Another approach to gain exposure to gold is through investing in gold-mining companies. By purchasing shares in these companies, you’re essentially betting on their growth and profitability. Share dealing has its own set of potential benefits:

-

- Leverage: Gold-mining stocks can offer more significant price movements than gold, amplifying both potential gains and losses.

- Dividend income: Some gold-mining companies pay dividends, contributing to the overall return of your investment.

Make sure you do thorough research on the companies and assess their financial health, operational efficiency, and management effectiveness.

As you devise your gold investment strategies for 2024, consider diversifying your portfolio, and evaluate various investment vehicles, such as ETFs and share dealing accounts. Staying informed and having a long-term view can empower you to manage inflation worries and navigate uncertainties in the investment landscape.

Global Perspectives and Market Trends

As you dive into the gold investment landscape in 2024, it’s crucial to understand the global perspectives and market trends shaping this valuable asset class. In this section, we’ll explore gold demand in technology and jewellery and the role of central banks in impacting gold prices.

Gold Demand in Technology and Jewellery

Gold has been a prominent component in various applications across technology and jewellery sectors, driving demand globally. The emerging markets of China and India have had a significant impact on gold demand, particularly in the jewellery segment.

In China, gold jewellery demand has consistently been on the rise, reflecting the country’s growing middle class and increasing consumer wealth. Similarly, India’s cultural affinity for gold jewellery, combined with its strong economic growth, has contributed to ever-increasing demand for the yellow metal.

In the technology sector, gold’s unique properties make it indispensable in electronics manufacturing, particularly in smartphones, computers, and other advanced devices. As global demand for consumer electronics continues to increase, gold’s role in this industry will likely remain significant.

Central Banks’ Influence on Gold

Central banks play a key role in influencing gold prices, primarily through their monetary policies, which affect interest rates and currency valuations. As market volatility increases and economies face uncertainty, central banks may implement measures to counter the challenges, often having a direct impact on gold investments.

For instance, the Bank of England has been actively managing inflationary pressures in the UK. In recent years, there have been concerns about rising inflation in various economies, leading to increased demand for gold as a hedge against these concerns.

Moreover, central banks around the world, including China and India, continue to add to their gold reserves as part of their diversification strategies. This trend not only strengthens gold’s position as a valuable asset but also has the potential to drive up its price in the long term.

By keeping a close eye on global perspectives and market trends, you can make more informed decisions regarding your gold investments in 2024, capitalising on the opportunities and mitigating potential risks.

Frequently Asked Questions

How might gold investment serve as a hedge against the projected inflation rates for 2024 in the UK?

Gold has historically been considered a safe haven asset in times of economic uncertainty and a good hedge against inflation. When inflation rates are high, gold prices tend to rise as well. A study by the World Gold Council found that gold has always had a returned of around 15% per year on average when inflation has been higher than 3%, compared to just over 6% per annum when inflation has been below 3%. By investing in gold, you can potentially safeguard your wealth from the eroding effects of inflation.

What steps can individuals take to shield their finances from the UK’s inflation predictions for the next year?

To protect your finances from inflation, consider diversifying your investment portfolio by including assets that are less affected by inflation, such as gold. You can invest in gold through various methods, including buying physical gold (coins or bars), gold exchange-traded funds (ETFs), or gold mining stocks. It’s important to research each option carefully and speak with a financial advisor to determine which method is most suitable for your financial goals and risk tolerance.

Additionally, focus on building an emergency fund, paying off high-interest debts, and increasing your income streams (e.g., through side gigs or investments) to ensure you can maintain your purchasing power during periods of high inflation.

With the Bank of England forecasting inflation changes, how does gold investment fit into the current economic climate?

The Bank of England forecasts that inflation will come down to 2% by the end of 2025. While easing inflation may lessen the appeal of gold as a safe haven asset, gold still offers diversification benefits within your investment portfolio. This is because gold often moves independently from other financial assets, like stocks or bonds. Moreover, global economic and geo-political uncertainties can increase gold’s appeal in the short term.

By including gold within your investment portfolio, you can benefit from its historically stable performance during periods of volatile inflation and market uncertainty, potentially balancing out riskier investments.

Leave A Comment