Will this be the Fall of Falls. 10 years after the Lehman collapse, will we again have an Autumn of Shocks in financial markets? The odds are very high!

Overstretched stock markets look extremely vulnerable including 13 recent Hindenburg Omens for the US market. The Dollar could soon be on its final leg to oblivion and US Treasury Bonds on the verge of a major fall that will eventually lead to hyperinflationary yields like Argentina and Turkey in the 20%+ region.

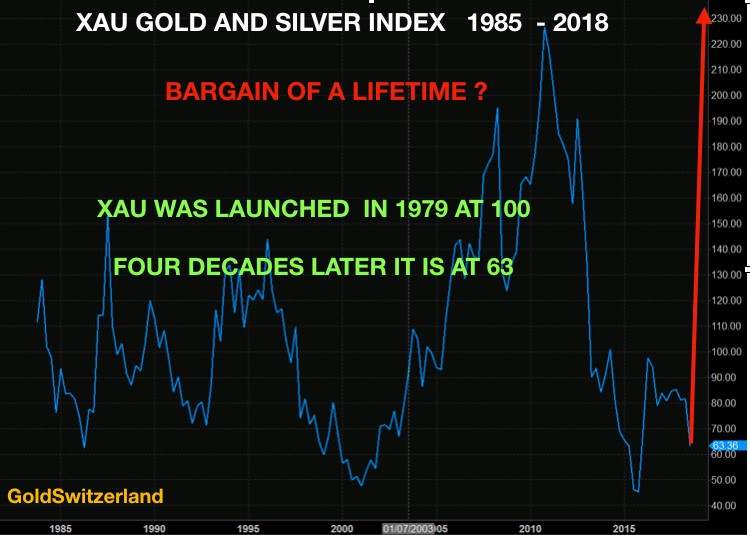

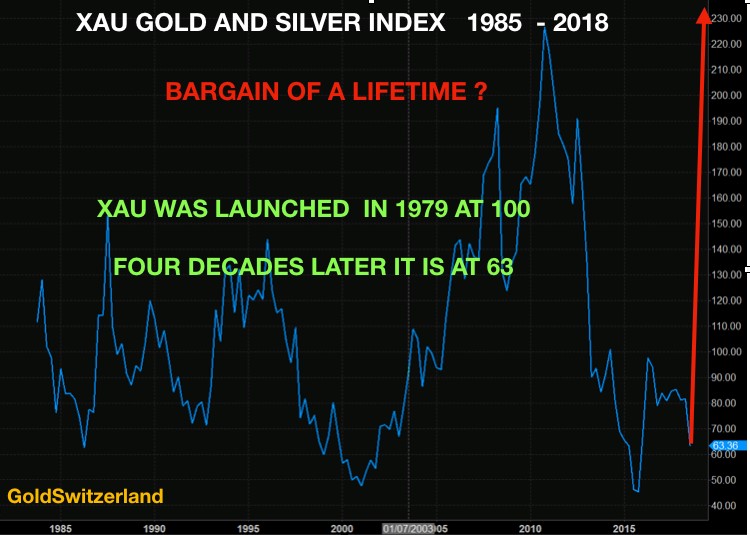

SILVER LINING & BARGAIN OF A LIFETIME

There is always a silver lining of course and a golden one. Silver and gold, together with precious metal stocks, will soon start an extraordinary journey to levels that few can imagine. The undervaluation of this sector is best represented by the XAU gold and silver index. At inception in January 1979, this index was 100 and today after four decades of inflation, money printing, and credit expansion, the index is standing at 63.

“IT IS DIFFERENT TODAY”

The final moves before a secular turn in world markets are often emotional roller coasters. Many investors know, at least subconsciously, that markets are overstretched and can turn at any time. Since Central Banks have consistently “saved” investors in the last few decades, why wouldn’t that continue? Stock market bulls might be apprehensive after a 9-year bull move. But very few are prepared to get out. Greed and recent experience tell them that “the market always goes up”. Very few know that the market fell 90% in 1929 to 1932 and took over 25 years to return to the 1929 level. And even if they did know, “it is different today because …..”

FOREX MARKET $6 TRILLION PER DAY OF WORTHLESS PAPER

Forex is the biggest market in the world with almost $6 trillion daily volume. So in just over 2 weeks, there is more currency trading volume than global annual GDP. It is, of course, a market with only paper trading and no physical settlement. Interestingly Deutsche Bank has 20% of all forex volume. No wonder that bank is more exposed than any other bank. Global daily Forex volume is 200 times the daily volume on the New York Stock Exchange. The value the currency, whether it is Dollars, Euros Yuan or Yen has a massive bearing on people’s standard of living. But very few understand this, mainly because no government tells their people that they are consistently destroying the value of the currency.

Leave A Comment