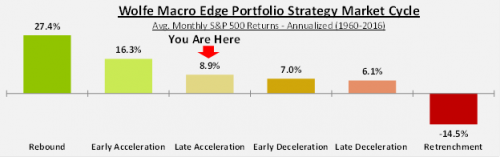

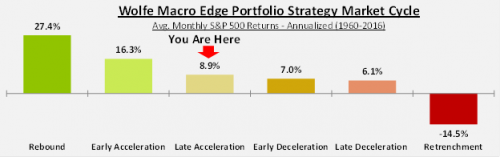

Given how long this recovery has run, many people assume that the US economy and stock market are in the latter stages of their bull run, ready to peak at any moment. However, Chris Senyek, Chief Investment Strategist at Wolfe Research, recently told Financial Sense Newshour that the market cycle is best characterized by six different phases and just entered the “late acceleration” phase in September 2017. Does the mean we are close to a market peak and economic recession? Not necessarily, and tax reform will play a large role, he says, in how long we remain in this phase before deceleration begins.

See Financial Sense Newshour podcast Chris Senyek: Market Cycle in Late Acceleration Phase for audio.

Source: Wolfe Research

Wolfe’s Framework

“We look at the markets from a top-down and a bottom-up perspective,” Senyek said. “From a top-down perspective, we’re always focused on monetary and fiscal policy. … We then combine that with a bottom-up approach. Through our earnings lens, we look at individual companies and what the impact might be on overall markets.”

Using its accounting and tax background, Wolfe builds up fundamentally-based data into key high-level market themes and then seeks to understand where we are in the market cycle based on leading economic indicators.

This provides a framework for evaluating overall market views, sectors, industries, and even thematic topics such as currencies, commodities and the global picture, Senyek stated.

The Case for the Late Acceleration Phase

In their market cycle work, there are six different phases to watch, Senyek stated. Right now, we’re in the third cycle, which is the late acceleration phase.

Many investors think we’re late cycle as they look at traditional measures such as months between recessions and the length of the expansion. In contrast, Wolfe Research views market cycles through the lens of the Conference Board Leading Index, which it has used to establish a framework of quantitative rules to define each phase.

Leave A Comment