Most public companies should benefit from the new tax law, which lowers the corporate tax rate from 35% to 21%. Analysts expect the S&P 500 to see a profit boost ranging from 7% to more than 10%. Optimism over the impact of the new tax law has helped the S&P 500 to a 6% gain in January.

Some companies will benefit more than others. Some of the biggest winners will be companies with large deferred tax liabilities (DTLs). These are companies that have deferred paying taxes by reducing taxable income in the past with a variety of accounting techniques such as accelerated depreciation, non-deductible intangibles, or holding international profits overseas. Companies that have used these methods record DTLs on their balance sheets to account for the higher taxes they expect to pay in the future.

These companies get an extra bonus from a corporate tax cut, since it applies not only to their regular taxes but also to the deferred taxes they were obligated to pay. Many companies will see their balance sheets improve significantly in the coming months as they decrease the value of their DTLs now that the lower corporate rate is coming into effect.

Identifying DTLs: Not as Easy as It Sounds

It sounds easy to just look for companies with large DTLs, but that process does not really work. Some companies don’t disclose DTLs on their balance sheet and only show them in the footnotes. Others might report DTLs on the balance sheet but also have offsetting deferred tax assets in the notes. Our machine learning Robo-Analyst technology helps us parse thousands of 10-Ks and 10-Qs to identify the true net deferred tax liabilities.

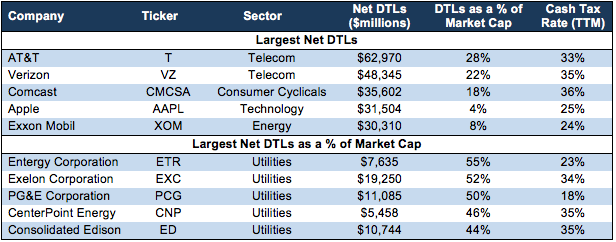

Figure 1 shows the five S&P 500 companies with the largest net DTLs as of their latest 10-K or 10-Q, and the five with the largest net DTLs as a percent of market cap.

Figure 1: Companies with the Largest Net Deferred Tax Liabilities

Sources: New Constructs, LLC and company filings

The Telecom sector stands out as the largest total winner. AT&T (T) and Verizon (VZ) have the largest DTLs by dollar value. Comcast (CMCSA), in third, is classified as consumer cyclicals but invests heavily in telecom infrastructure.

Leave A Comment