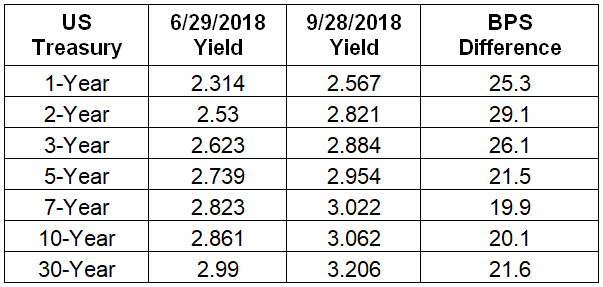

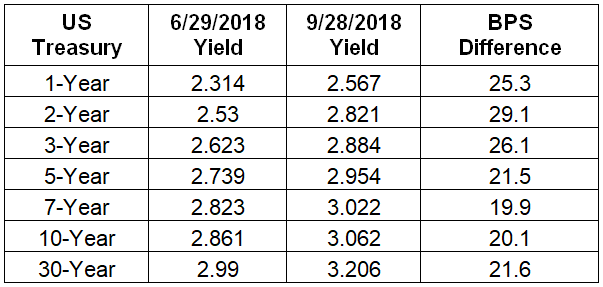

Treasury yields went up across the curve throughout the third quarter of 2018. Once again the rate move was led by the front end of the yield curve, with Treasury bills and notes out to three years experiencing the largest increase in yield.

The longer-dated Treasuries were not far behind, with the 10-year Treasury holding above 3% and the 30-year Treasury above 3.2%. The table below shows the increase in Treasury yields over the third quarter of 2018.

A yield greater than 3% on the 10-year Treasury has been viewed as a key psychological level for market participants. The belief is that a 10-year Treasury holding above 3% could trigger an upward trajectory in longer rates moving forward. There are a few obstacles that could stand in the way of that happening, however. One of the most substantial would be other major government bond markets’ (such as Germany and Japan) having 10-year yields much closer to zero than to 3%. A yield topping 3% makes the US – the largest bond market in the world – an attractive alternative for international investors. In a world starved for yield, the current yield on the 10-year and 30-year Treasuries appears to be the best game around for government bond investors. Increased demand for these securities at current levels could potentially keep yields where they are or even push them lower, leading to continued flattening of the yield curve. This dynamic is something we are continuing to monitor, and it is why we are maintaining a small weighting on the long end of the yield curve. Below is a graph that shows a comparison of 10-year US, German, and Japanese government bonds over the last year.

At the September 26th FOMC meeting, the Fed raised the fed funds target rate 25 basis points to a target range of 2.00–2.25%. This marks the eighth hike in the cycle and puts the fed funds rate at its highest level since October 2008. The statement accompanying the meeting remained mostly in line with forecasts from the previous meeting. The one major exclusion was the statement regarding monetary policy’s remaining “accommodative,” and its omission could lead people to believe that further hikes would potentially restrict growth moving forward. Other than the elimination of the “accommodative” statement, there were no changes to how the Fed described the current economic environment; and the median forecast for future rate hikes remained unchanged.

Leave A Comment