Meanwhile, in more “what could go wrong?” news from the cryptocurrency space, TD Ameritrade is set to allow Bitcoin futures trading starting on Monday.

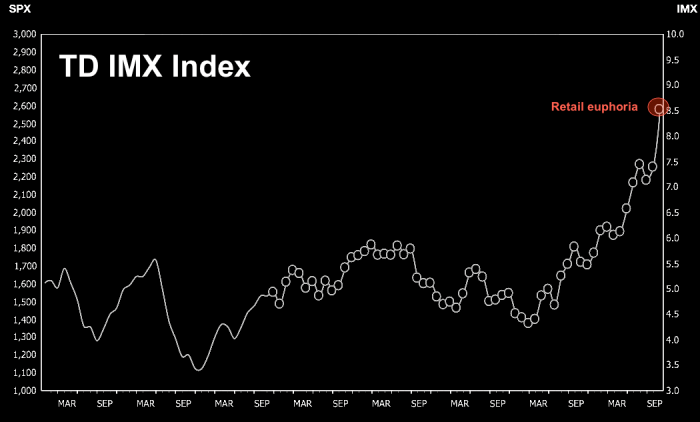

TD boasts the largest futures operation in the online brokerage space, so this clearly has the potential to bring even more retail investors into the fray. And you’ve got to know there will be some enthusiasm because as we learned last week, TD’s clients are all-in on stocks with the brokerage’s proprietary index that tracks holdings, positions, trading activity, and other data from client portfolios witnessing its largest single-month increase ever in November, jumping over 15% to an all-time high of 8.53:

Apparently, the minimum account balance to be eligible is $25,000 and the margin requirement will be 1.5X the CBOE requirement. Notably, this is only for the CBOE futures – for now, the CME futs (which start trading on Sunday), will not be available.

As noted on Thursday, Bitcoin futures have gotten off to a decent albeit a slow start. Although it’s not entirely clear how useful a statistic this is, it’s worth mentioning that the they did get off to a faster start than VIX futures got off to in 2004:

Over the course of the week, what was initially an ~8% premium to spot has narrowed, reducing the arb opportunity:

As Bloomberg reminds you, “it’s not uncommon for a brokerage to impose steeper requirements than the exchange,” and as you know, Interactive Brokers is now allowing short positions. Meanwhile, Goldman is clearing trades under very restrictive conditions.

So we’ll see. The bottom line is that this represents a further opening of the flood gates and potentially paves the way for more banks and brokerages to open their hearts and minds.

An optimistic interpretation is that this will make the market deeper and more liquid. A pessimistic interpretation is that tempting retail investors to trade Bitcoin futures is, to quote Ron Burgundy, “the most horrible thing I’ve ever heard”…

Leave A Comment