Traditional Markets

He was said to be the president for the traders and so far Donald J Trump has not disappointed in bringing market volatility. Even though market participants were well prepared for the decision to exit the Iran deal, it didn’t stop things from getting shaky when the announcement was made.

Here’s the price of oil. The purple circle is when Trump spoke.

Expect the inventories announcement today to be exciting.

Also take a look at gold, which is falling pretty hard this morning. It’s rather rare for gold to fall when political tensions are rising. Perhaps due to Dollar strength, which we will look at below.

Other than political rhetoric, it seems the economic impact of Trump’s decision could be a bit more muted than most people think. Many companies had been a bit languid to spark up new deals with Iran since Obama eased the sanctions.

The exception is Boeing, who will reportedly lose out on $20 Billion worth of deals but even their stock seems to be holding up alright given the circumstances.

Over to Currencies

There’s no denying it now, the Dollar is on a tear.

Here we can see the USD’s relative performance over the last three months.

The EURUSD has broken strongly below 1.2000, and the GBPUSD is holding on tightly to 1.3500, possibly hoping for a miracle from Mark Carney tomorrow.

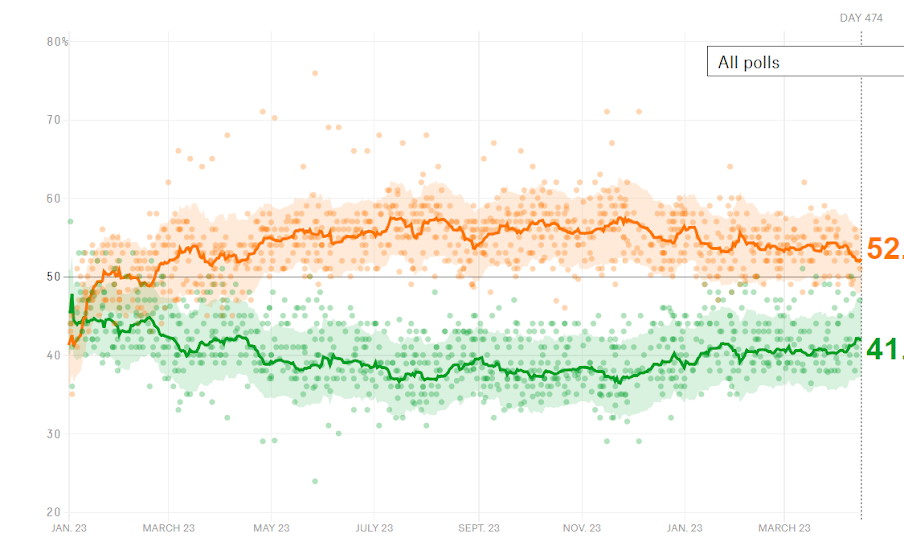

Shorting the Buck was one of the most popular trades of 2017 so what we’re seeing now is likely due to some of those trades unwinding, but can also likely be linked to Trump’s rapidly rising approval rating.

Also, as I’m writing I saw something interesting about a possible meeting in Turkey to sort out the country’s finances. The USDTRY is reacting.

Bitcoin Pleasantly Stable

We mentioned above some of the possible reasons that cryptos are falling in the medium term. For those looking for a news event to blame for the declines of the last few days, the best explanation I’ve seen is the new Japanese regulations.

Leave A Comment