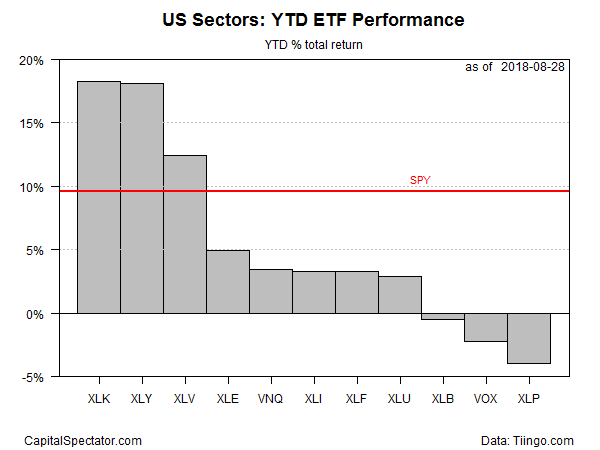

Shares of technology and consumer discretionary companies are dominating this year’s horse race for US sector returns, based on a set of exchange-traded funds (ETFs). Both slices of the US equity market are neck and neck through yesterday’s close (August 28) for year-to-date performance, posting results that are well ahead of the other sectors.

After stumbling late last month, tech and consumer discretionary stocks have rebounded in August and are now sharing a decisive edge for sector returns in the final days of August. Technology Select Sector SPDR (XLK) is in the lead by a hair, posting an 18.2% total return year-to-date, fractionally ahead of the 18.1% gain for Consumer Discretionary Select Sector SPDR (XLY).

Both ETFs are enjoying a solid edge over the rest of the sector field and the broad US equity market. Although health care shares have delivered a strong third-place gain year to date, the remaining sectors are far behind the tech and consumer discretionary rallies.

The worst-performing sector in 2018: Consumer Staples Select Sector SPDR (XLP), which has lost 4.0% year to date.

The US stock market overall, based on the SPDR S&P 500 (SPY), is up a relatively middling but nonetheless impressive 9.6% so far this year.

The recent weakness for tech and consumer discretionary shares raised the possibility that new sector leadership was evolving. But as the performance chart below reminds, both sectors (the green and black lines at the top) regained their footing and pulled further away from the rest of the market in August.

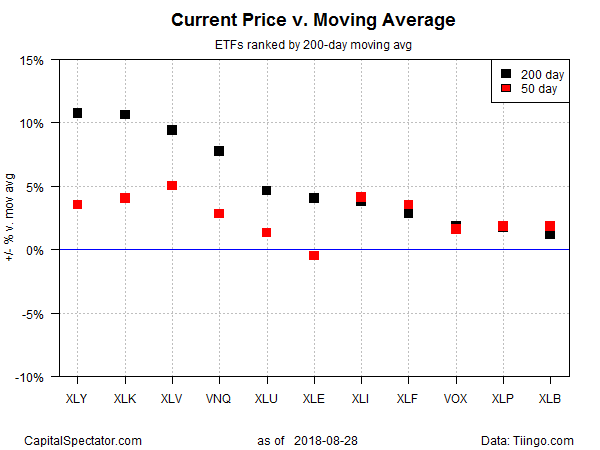

The dominance of tech and consumer discretionary is also prominent via ranking the sector ETFs by current price relative to 200-day moving average. On this momentum score, XLY and XLK are in the lead.

Profiling the sector ETFs based on current drawdown reveals that three funds closed at peaks on Tuesday: XLK (technology), XLV (health care), and XLY (consumer discretionary). By contrast, Energy Select Sector SPDR (XLE) has the biggest current drawdown at the moment: the ETF closed yesterday at more than 17% below its previous peak.

Leave A Comment