Indicators

Sectors to Watch Today

Technology was the market leader yesterday – and a good sign for equities that Tech was back at the top. Energy showing some willingness to bounce but still lots of resistance overhead. Discretionary and Industrials should be targeted today as potential areas of strength in a market bounce.

My Market Sentiment

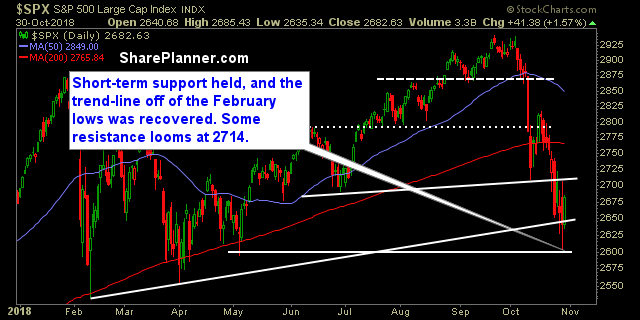

I am looking for follow through today on SPX, and the first day of consecutive gains for the market in the month of October. The market, should it hold its opening gap, is poised for a major move, as little short-covering has been seen in this market, relative to the amount of selling we have seen so far this month. Some support in the chart below has finally been found for the market, though I wouldn’t trust the market that this is anything beyond a dead cat bounce.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment